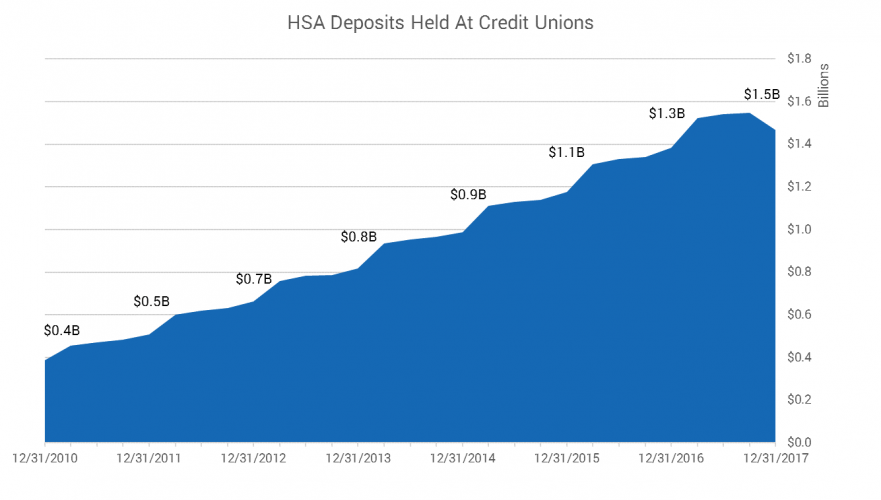

On March 7th we published our latest quarterly analysis of how health savings accounts are faring amongst credit unions. According to the latest NCUA filings, as of December 31st credit unions held $1.47 billion in HSA deposits amongst what we would estimate to be roughly 577,000 accounts.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

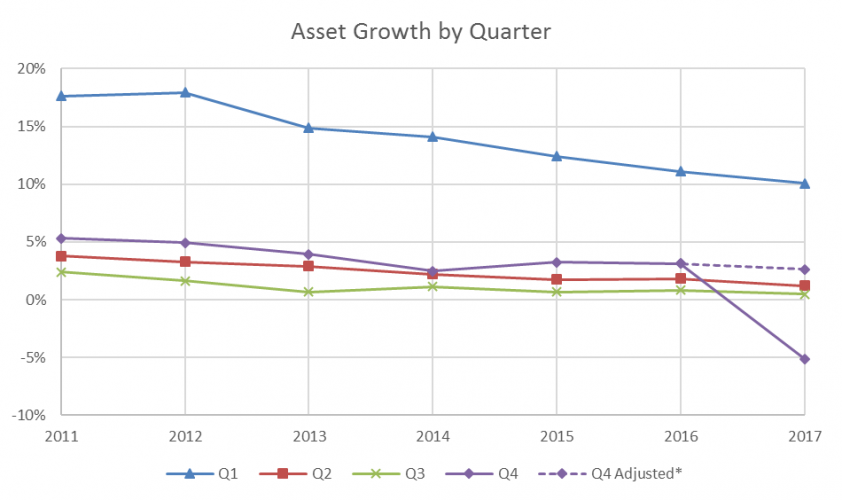

Credit Union assets were up 6.2% in 2017; adjusting for the HealthEquity acquisition of Alliant Credit Union’s HSA business that number would have been higher. As we have seen with the overall market, HSA asset growth among credit unions has been historically cyclical with employers often funding accounts at the beginning of the year.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

* Q4 Adjusted assumes Alliant Credit Union’s Q4-2017 HSA asset growth is equal to their 3-year Q4 average.

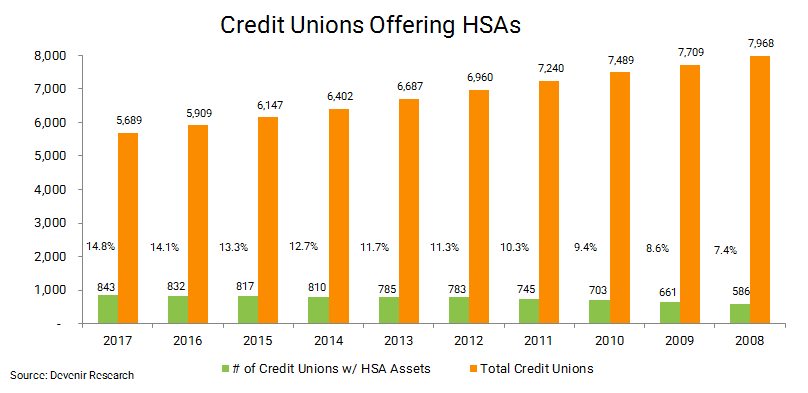

As consumer and employer demand for HSAs increases, more credit unions have begun to offer them. At the end of 2017, 843 of the 5,689 NCUA credit unions held HSA deposits.

Of those credit unions holding HSA deposits as of 12/31/17, 62 of them hold over $5 million in HSA deposits and 225 held over $1 million in HSA deposits.

| Number of NCUA Credit Unions With… | |

|---|---|

| Over $5 Million in HSA Deposits: | 62 |

| Over $1 Million in HSA Deposits: | 225 |

| Over $500,000 in HSA Deposits: | 320 |

| With HSA Deposits: | 843 |

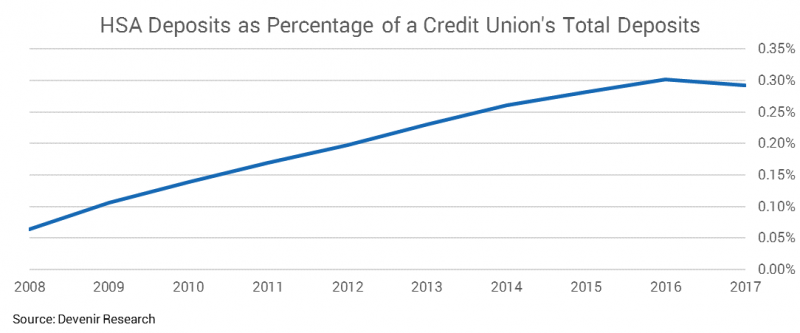

While the growth of HSAs has been exciting and promising, they still represent a small portion of the typical HSA credit union asset base. At the end 2017, HSA deposits only represented on average 0.29% of total deposits for those credit unions offering health savings accounts.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

We continue to be interested in HSA adoption amongst credit unions and will continue to report on NCUA filings on a quarterly basis. Thank you for reading and feel free to reach out to our research team at [email protected] if you have any questions or thought’s you’d like to share!