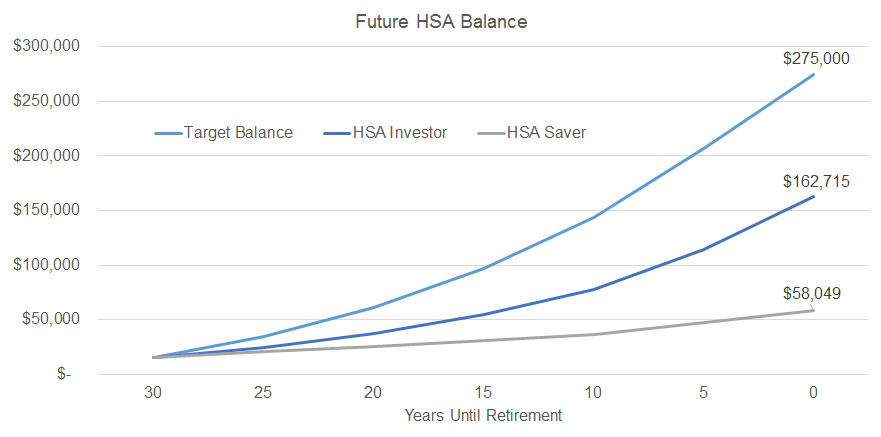

HSAs have become an important part of the healthcare retirement picture for millions of Americans as employers continue to realize the cost saving benefits of HSAs. Fidelity projects that a 65-year old couple retiring in 2017 would need approximately $275,0001 in today’s dollars to cover healthcare costs through retirement, up 6% from their 2016 estimate. Are HSA investors on track to meet this hurdle?

Devenir investment balance projections show that the average HSA investment account falls roughly $110,000 short of Fidelity’s target using estimated* assumptions about the average HSA investment account-holder. And that is in today’s dollars. Adjusting for 2% inflation that number could spike to roughly $498,1242 in 30 years.

| Investment Balance | $11,594 |

|---|---|

| Deposit Balance | $3,552 |

| Hypothetical Net Annual Contribution | $1,000 |

| Hypothetical Annual Investment Return | 6.0% |

| Hypothetical Deposit Interest Rate | 0.30% |

| Retirement Age | 65 |

| Current Age | 35 |

| Catch-Up HSA Contribution | $1,000 |

| Years to Retirement | 30 | 25 | 20 | 15 | 10 | 5 | 0 |

|---|---|---|---|---|---|---|---|

| Investor Deposit Balance | $3,552 | $3,606 | $6,660 | $3,715 | $3,771 | $3,828 | $3,886 |

| Investor Investment Balance | $11,594 | $21,152 | $33,994 | $51,062 | $73,969 | $110,262 | $158,829 |

| HSA Investor (deposits + investments) | $15,146 | $24,758 | $37,604 | $54,777 | $77,740 | $114,090 | $162,715 |

| HSA Saver | $15,146 | $20,405 | $25,743 | $31,161 | $36,662 | $47,275 | $58,049 |

| Target Healthcare Retirement Balance | $15,146 | $34,852 | $61,223 | $96,513 | $143,740 | $206,939 | $275,000 |

In order to meet the estimated 2017 healthcare retirement hurdle, HSA investors would need to contribute on average an estimated $2,587 per year. Leaving a $1,587 gap from current HSA investor contributions assuming an account maintains its deposit balance.

1. Estimate based on a hypothetical couple retiring in 2017, 65-years-old, with life expediencies that align with Society of Actuaries’ RP-2014 Healthy Annuitant rates with Mortality Improvements Scale MP-2016. Estimates may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Costs Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

2. Estimate of $275,000 adjusted for 2% annual inflation over 30 year time horizon.

Investments are not FDIC insured and may lose value.