Our February 2025 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

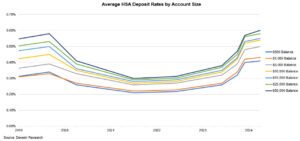

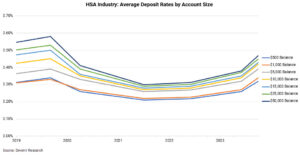

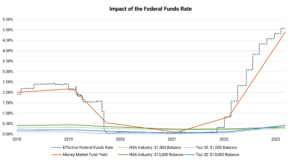

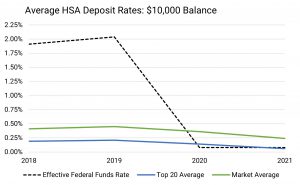

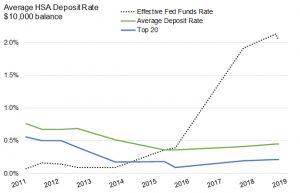

HSA deposit rates are showing signs of cooling after sustained growth throughout 2023-24, with $50,000 balances dropping from 0.63% to 0.61% between September and December 2024. This shift aligns with the Federal Reserve’s more accommodative monetary policy, as the Effective Federal Funds Rate decreased from 5.33% in the summer of 2023 to 4.33% at the end of 2024. Learn how these changes impact HSA providers, employers, and account holders in today’s evolving economic landscape.

Our January 2025 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

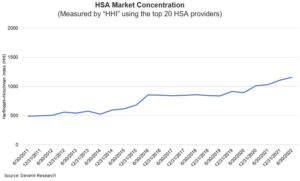

Our 2024 Midyear HSA Research Report reveals a continuing trend of market concentration. The top 5 largest HSA providers now hold 73% of the industry’s total assets.

Our December 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our November 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

As we enter the final quarter of 2024, Health Savings Account (HSA) interest rates have modestly increased across all balance tiers. As of September 30th, the average rate for $1,000 balances rose to 0.45%, up from 0.44% in June. Despite a declining federal funds rate to 4.83%, HSA rates continue to climb, showing providers’ commitment to offering competitive interest. The rate spread between $1,000 and $50,000 balances remains steady at 18 basis points.

Our October 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our September 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our August 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

As we enter the second half of 2024, HSA interest rates continue their upward trajectory, with increases across all balance tiers. As of June 30th, the average rate for $1,000 balances reached 0.44%, up from 0.42% in December 2023. More substantial gains are seen in higher balances, with $10,000 accounts now averaging 0.55% (up from 0.52%) and $50,000 balances hitting 0.62% (up from 0.57%).

Our July 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our June 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our May 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

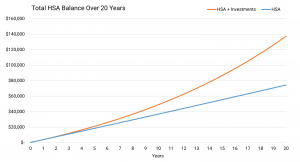

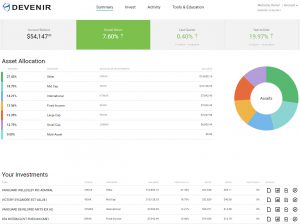

More informed account holders are better positioned to make the decisions necessary to achieve their financial goals. Devenir is committed to providing industry leading HSA tools and education to guide account holders through their healthcare saving journey. As part of that mission, our team is excited to announce the release of our new HSA Balance Projection Calculator!

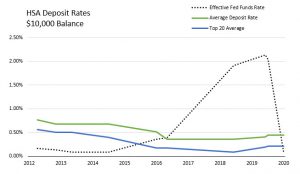

In its fifth consecutive meeting, the Federal Reserve has maintained the federal funds rate between 5.25% and 5.50% for the first quarter of 2024, signaling that the rate may have peaked this cycle. Projections from the Fed’s March FOMC meeting suggest a possibility of 75 basis points reduction in 2024, contingent on economic data aligning with their 2% inflation target. Concurrently, HSA deposit rates have increased slightly since 2021, with average rates at 0.43% for a $1,000 balance and 0.54% for a $10,000 balance as of March 31st, 2024, indicating a gradual upward trend influenced by tiered rate schedules.

Our April 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our March 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our February 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

The rapid rise in the federal funds rate over the course of 2022 and 2023 has resulted in continued increases in the average rate paid on HSA deposit balances. As of December 31st, 2023, HSA providers are paying an average rate of 0.42% at the $1,000 balance threshold, an increase of 8 basis points from September 2023.

Our January 2024 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our December 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our November 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

In the latest financial update, we explore the intriguing upward trend in HSA deposit rates that have paralleled recent hikes in the federal funds rate. As the Federal Reserve strategizes potential additional rate hikes, we notice a consistent climb in HSA rates across different balance thresholds.

Our October 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our 2023 Midyear HSA Research Report reveals a continuing trend of market concentration. The top 5 HSA providers now hold 70% of total assets, a slight increase from last year.

Our September 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our August 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Our July 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

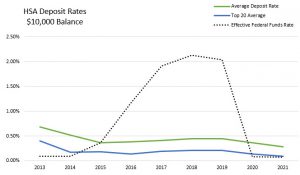

A lot has changed since we last wrote about HSA deposit rates. Inflation proved to be higher and stickier than Fed officials had previously thought, leading to the most aggressive rate hiking cycle in decades. So how has this impacted HSA deposit rates across the industry?

Our June 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

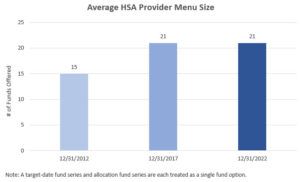

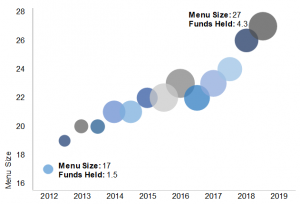

We recently published a white paper sharing some of our views on HSA investment menu design. As a follow up to that piece, we thought it would be interesting to compare past and present HSA investment menus and see if there are any noticeable trends taking place on an industry-wide level. We looked at provider fund lineups as of 12/31/2022 and then went back 5 and 10 years for comparison. This post takes a look at some of the things that stood out to us.

Our May 2023 HSA newsletter highlighting articles, posts and press releases to help keep you in the loop of the latest in the HSA market.

Check out our April 2023 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our March 2023 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

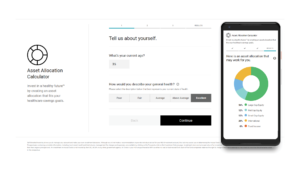

We are excited to announce that an updated version of HSA Guided Portfolio is available now! HSA Guided Portfolio is our powerful decision support tool that empowers investors to act.

Check out our February 2023 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our January 2023 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our December 2022 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our November 2022 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our October 2022 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

In September 2020, we published a blog post on HSA market concentration. At the time it was published, the HHI of the top 20 HSA providers was just under 1,000, signaling a competitive market. However, since then, there have been several acquisitions in the HSA market and as a result, we wanted to recalculate the HHI using data from our 2022 Midyear HSA Research Report.

Check out our September 2022 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

Check out our August 2022 HSA newsletter highlighting articles, posts and press releases that help keep you in the loop of the latest trends and developments in the HSA marketplace.

We are excited to announce that a new version of our HSA Asset Allocation Calculator has been released.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our July 2022 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our June 2022 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our May 2022 edition!

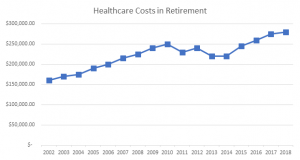

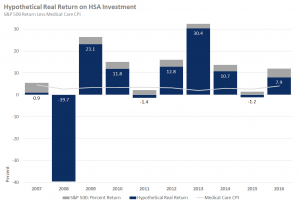

While people are trying to keep up with the inflation to consumer goods prices, they also need to be aware of how much more they are going to have to spend on health care.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our April 2022 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our March 2022 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our February 2022 edition!

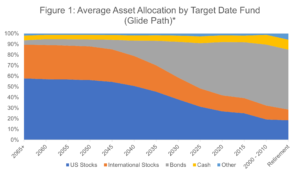

Are target-date funds a good fit for HSAs? As a leading investment consultant in the HSA market, Devenir is mindful of this ongoing debate and the nuances of target date funds in 401(k)s and HSAs. We analyzed the usage of target date funds in HSAs and have highlighted our findings here.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our January 2022 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our December 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our November 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our October 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our September 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our August 2021 edition!

So far, without any change in activity from the Federal Reserve, Devenir has not seen any dramatic impact on deposit rates offered in HSAs. Since our last update in February, we have observed a market average decline of two-basis points for accounts with $1,000 and a four-basis point decrease for accounts with $10,000.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our July 2021 edition!

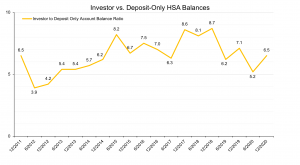

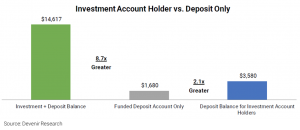

As HSAs continue to grow in popularity and the number of accounts steadily increases, financial institutions are starting to realize the full value of these accounts. However, as the HSA market becomes more competitive, providers must find new ways to differentiate themselves and provide value to their account holders. One way that institutions can help account holders take full advantage of their HSAs is to offer investments.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our June 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our May 2021 edition!

We published our latest analysis of how health savings accounts are faring among credit unions, finding at the end of 2020 credit unions held about $1.97 billion in HSA deposits.

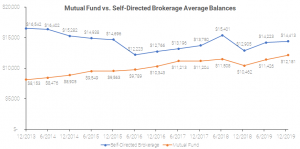

HSA investments have grown rapidly in recent years, as more account holders invest and existing investors grow their balances. At the end of 2020 nearly $24 billion dollars were invested, accounting for roughly 29% of total HSA assets (up from 24% at the end of 2019).

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our April 2021 edition!

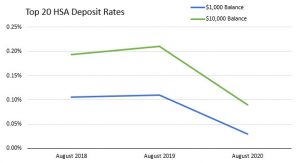

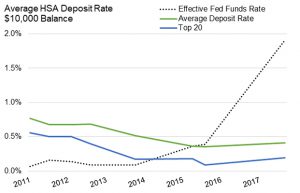

On February 23rd and 24th, Federal Reserve Chairman Jerome Powell testified before Congress that the Federal Reserve does not plan to change their current monetary policy in the near term. Since the onset of the pandemic, consumers have seen the effect of these decisions on their bank deposits. The average deposit rate, for an account holder with $1,000 in their health savings account (HSA) has dropped 10bps since 2019.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our March 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our February 2021 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our January 2021 edition!

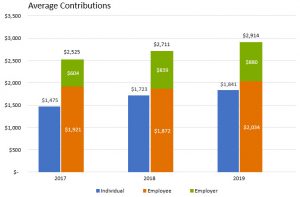

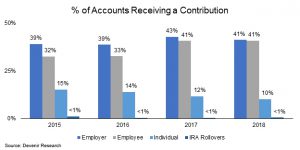

One interesting HSA datapoint that our team has been tracking is the behavior of accountholders who are associated with an employer group versus accountholders who are not. Over the last three years, employer associated HSAs have seen the highest average contributions.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our December 2020 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our November 2020 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our October 2020 edition!

The HSA marketplace consists of providers from a variety of backgrounds from health plans, banks & credit unions, to technology providers. In addition to the wide range of business models, HSA providers come in many sizes as well.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our September 2020 edition!

Devenir, as part of our continued monitoring of the health savings account (HSA) marketplace, has been tracking HSA deposit rates. Since our last update, average deposit rates for the top 20 HSA providers in the marketplace have remained fairly steady with only a slight decline for both the one-thousand and ten-thousand dollar balance levels.

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our August 2020 edition!

Each month Devenir highlights a selection of articles, posts and press releases to keep you in the loop of the latest trends and developments in the HSA marketplace. Check out our July 2020 edition!

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

As HSA investment accountholders react to the financial and public health impact of the COVID-19 pandemic, Devenir has observed HSA investors to better understand how the crisis has shaped their investment behavior.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

The coronavirus pandemic in the United States forced the Federal Reserve to cut rates close to zero in order to dampen the effect of the virus on the U.S. economy. In this unique time, Devenir has been observing how health savings account (HSA) providers have reacted to the rate cut.

We published our latest analysis of how health savings accounts are faring among credit unions, finding at the end of 2019 credit unions held about $1.76 billion in HSA deposits.

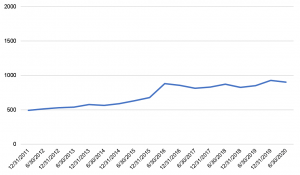

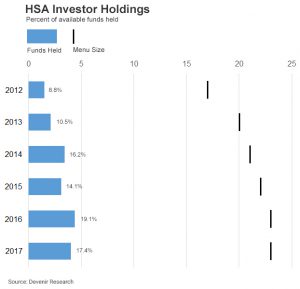

HSA investments have grown rapidly in recent years, reaching 24% of total assets and over 1.2 million (4%) accounts as of 12/31/2019. The average investment balance for investment account holders has grown to $12,695 in 2019, from roughly $5,000 in 2011. When it comes to investing, HSA account holders generally have the option to choose from a list of pre-selected mutual funds, however, some HSAs allow for investment in a linked self-directed brokerage (SDB) option (allowing investment in individual securities).

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

An important aspect of the menu design process is sizing the menu to optimize the availability of core asset classes while also limiting excessive overlap or overly risky asset classes that can overwhelm the typical investor. This blog considers four important factors that impact sizing decisions of HSA menus.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Devenir is excited to announce that we have partnered with the Centers for Medicare & Medicaid Services to supply info.HSAsearch.com, a powerful HSA provider search tool and comparison resource.

We are thrilled to announce that we will be rolling out this new HSA investment portal with our partners over the coming year!

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

In an effort to understand industry trends, we periodically research publicly listed interest rates offered by HSA providers. Recent averages suggest providers may not be feeling much pressure to raise HSA deposit rates, with the largest providers feeling even less pressure as they focus on providing value in other areas.

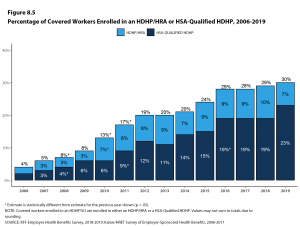

Kaiser Family Foundation recently released their 2019 check up on employer health benefits. The report shows promising growth in HSA adoption among employees, with 23% of covered workers now enrolled in an HSA-Eligible health plan, up from 19% a year ago.

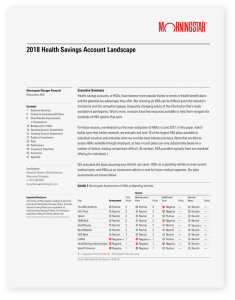

Morningstar® released its 2019 rendition of their Health Savings Account Landscape report, which evaluated 11 HSA providers based on their potential appeal to an individual looking to open an HSA.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

While the portion of HSA account holders investing in their HSA is still relatively small, there have been significant efforts across the industry to increase HSA account holder engagement, including efforts to raise awareness about the availability of investment options. With this in mind, now is a great time to look at some behavioral roadblocks facing HSAs and HSA investments.

Subscribe to Devenir’s monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

HSAs received record-breaking contributions in 2018 with accountholders and employers pouring $33.7 billion into HSAs, up 22% from 2017. The record contributions have also led to a new record carry-forward balance of $8 billion in 2018 showing that in aggregate, HSA accountholders may be recognizing the long-term savings potential of the account.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

We published our latest quarterly analysis of how health savings accounts are faring among credit unions at the beginning of March, finding at the end of 2018 credit unions held about $1.62 billion in HSA deposits.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

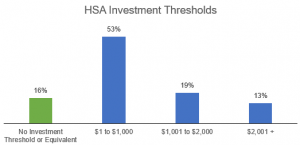

Due to the transactional nature of health savings accounts, HSA providers often require accountholders to maintain a certain balance in cash before allowing them to invest. We take a quick look at how prevalent these thresholds are in the industry and what are the different ways in which they are used.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

In an effort to understand industry trends, we periodically research publicly listed interest rates offered by HSA providers. Recent averages suggest providers may not be feeling much pressure to raise HSA deposit rates, with the largest providers feeling even less pressure as they focus on creating account value through other means.

Morningstar® released its 2018 rendition of their Health Savings Account Landscape report, which evaluates 10 HSA providers based on their potential appeal to an individual looking to open an HSA.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Several studies have shown investors can feel overwhelmed by overly large investment menus. Large menus have been shown to decrease participation rates in retirement plans as participants weight their options. But how big is too big when it comes to fund lineups?

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

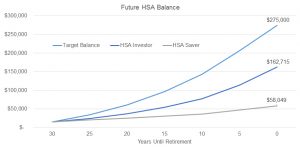

Fidelity recently updated their estimate for what a retirement age couple will need to have saved for health-related expenses in retirement. The most recent estimate of $280,000 is up 2% from last year which is below the average increase of 4% since the number was first estimated in 2002. Are HSA investors on track to meet this hurdle?

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

We published our latest quarterly analysis of how health savings accounts are faring among credit unions at the end of the year, finding at the end of 2017 credit unions held about $1.47 billion in HSA deposits among, by our estimate, 577,000 accounts.

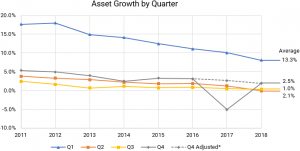

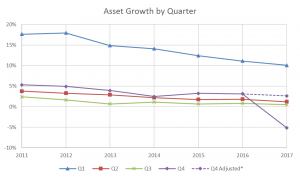

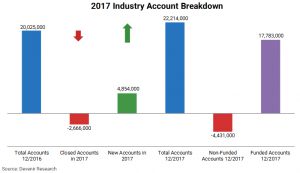

What happened to HSA account growth in 2017? It’s a question we’ve been receiving a lot since we released our report in February and we wanted to help provide some clarity.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

The dynamics of the healthcare marketplace have shifted in recent years, increasing the consumers role in selecting coverage that is appropriate for them. While consumers have been tasked with actively participating in the healthcare marketplace, they still may struggle in doing so effectively.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

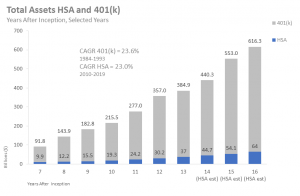

To wrap up the series we comment on comparable growth trends in each marketplace and give our thoughts on outlook of HSAs.

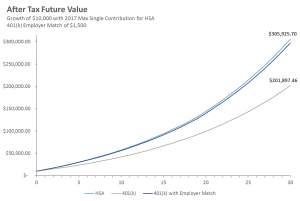

With the next installment in our 3-part blog series we cover another important difference between investing in an HSA and 401(k). Part 1 pointed out the flexibility of HSAs and detailed the primary uses of the account. In this post we look at both accounts through an investment lens and how retirement with a healthcare focus can affect investing.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you in the loop of the latest trends and developments in the HSA marketplace.

As part of our continuing effort to inform investors about HSAs, we will be posting a three-part blog series comparing HSAs to 401(k)s for use as a retirement savings vehicle. While the two accounts are often compared at a high level, we take an in-depth look at the benefits and limitations of each account highlighting three reasons investing in an HSA is more nuanced than it’s 401(k) counter-part.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you abreast of the latest trends and developments in the HSA marketplace.

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you abreast of the latest trends and developments in the HSA marketplace.

HSAs have become an important part of the healthcare retirement picture for millions of Americans as employers continue to realize the cost saving benefits of HSAs. Fidelity projects that a 65-year old couple retiring in 2017 would need approximately $275,000 in today’s dollars to cover healthcare costs through retirement up 6% from from their 2016 estimate. Are HSA investors on track to meet this hurdle?

Subscribe to our monthly newsletter and stay up to date with the latest HSA news! Each month Devenir highlights a selection of articles to keep you abreast of the latest trends and developments in the HSA marketplace.

© Copyright 2025 Devenir Group, LLC. All Rights Reserved. Disclosure | Privacy Policy