Summary:

Target date funds have been growing in popularity over the past couple decades, due in part to their use in employer-sponsored retirement plans such as 401(k)s. Another employer-sponsored program that is gaining popularity is the HSA-eligible health plan and the corresponding health savings account (HSA). Familiarity amongst employers with target date funds offered through their 401(k)s may be leading some to want them included among their HSA investment options as well. However, this raises the question of whether target date funds make sense as investment options for savings vehicles such as HSAs, where participant usage can vary widely from that of 401(k)s.

As a leading investment consultant in the HSA market, Devenir is mindful of this ongoing debate and the nuances of target date funds in 401(k)s and HSAs. Using investment holdings data from the Devenir database, we analyzed the usage of target date funds in HSAs and have highlighted our findings below. These findings and other insights are used to curate our investment programs through effective education, investment options, and other resources that help HSA investors invest in a healthy futureTM!

Target Date Fund Basics

Let’s first get familiar with target date funds in general. A target date fund is a fund that invests in other funds, often called a “fund-of-funds”. For example, a Vanguard target date fund will have an allocation comprised of Vanguard mutual funds. The funds are designed to provide investors with a diversified portfolio that is properly allocated based on their desired retirement year.

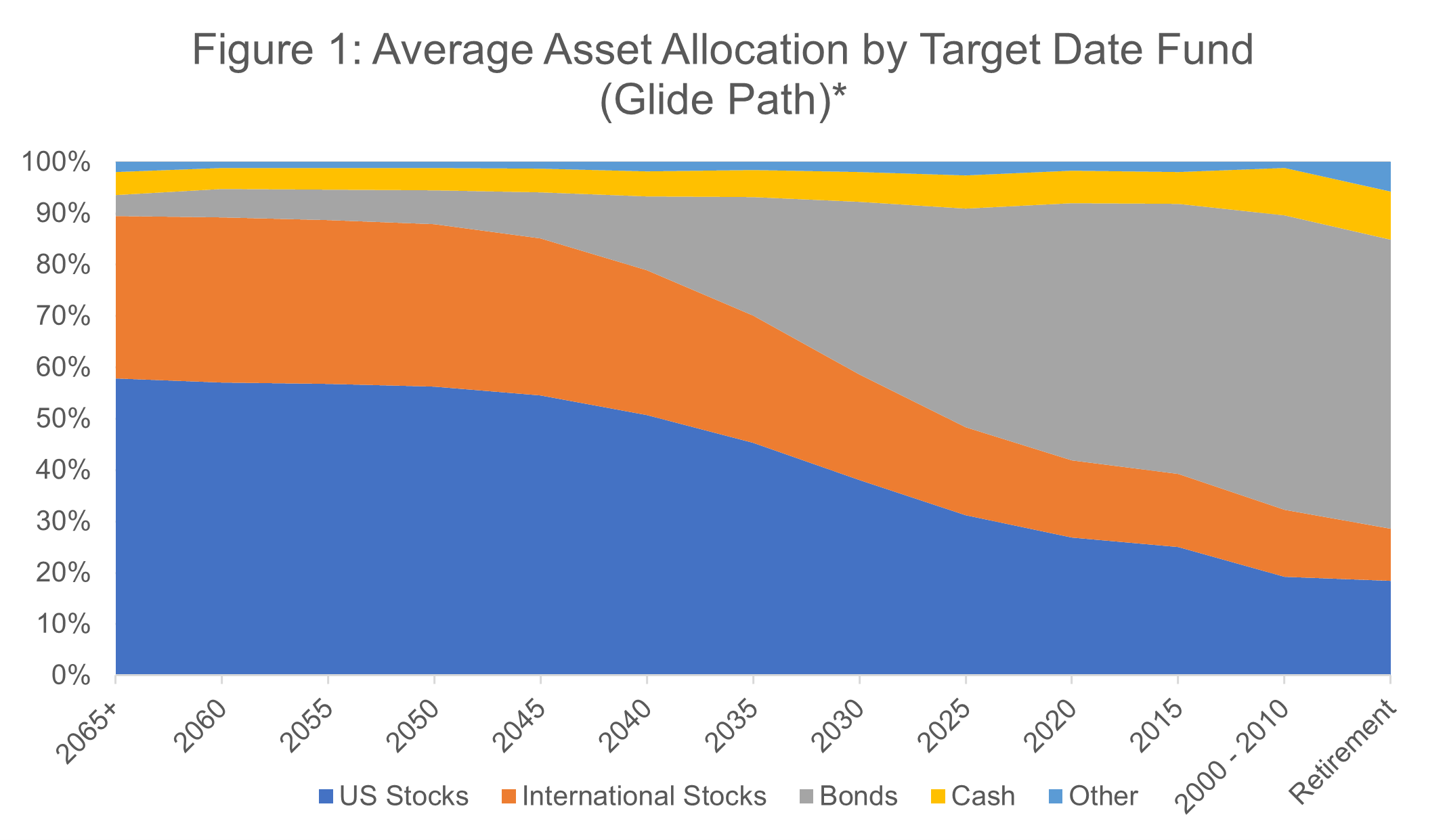

Maintaining and rebalancing the asset allocation is a key objective for target date funds. They generally start out with a higher allocation to equities relative to bonds the further out the target retirement date is. As time goes on, the asset allocation gradually shifts to become more conservative by moving portfolio weights from equities to bonds. This transition eventually refocuses the investment objective from growth to income and capital preservation. This shift is often called the fund’s glide path.

Figure 1 illustrates the average asset allocation of target date funds from several well-known fund families. As you can see, a 2065+ target date fund will start out mostly allocated to US and international equities but gradually shift these allocations towards bonds the closer it gets to retirement.

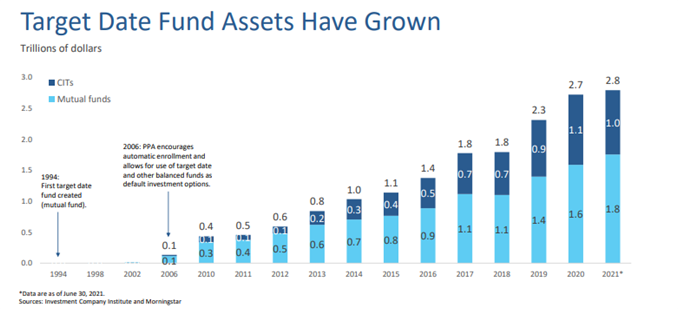

The first target date fund was created in 1994 through the work of Wells Fargo and Barclays Global Investors, but they were not widely used by investors at the time. The catalyst for change was the passage of the Pension Protection Act in 2006. This legislation encouraged auto enrollment in employer-sponsored retirement plans and allowed for target date funds and other balanced funds to be used as a qualified default investment alternative (QDIA), thereby leading to an increase in retirement plan participation and the usage of target date funds.

The use of target date funds in 401(k) plans has significantly increased in the past decade. According to the Investment Company Institute (ICI), 401(k) assets in target date funds have increased from 7% of total assets at year-end 2008 to 27% at year-end 2018. Participant usage of target date funds has also increased, from 31% of 401(k) plan participants to 56%, during this same time. Finally, the amount of 401(k) plans that offered target date funds and the share of 401(k) plan participants who were offered target date funds have remained stable during this same timeframe at 79% and 78%, respectively, at year-end 2018.

More recently, the Employee Benefit Research Institute (EBRI) and ICI reported that there were approximately $2.8 trillion in target date fund assets at the end of June 2021.

Target Date Fund Usage in HSAs

According to the Devenir 2021 Midyear HSA Research Report, 69% of participating HSA providers offered target date funds in their investment lineups.

For those HSA plans that offer target date funds, 10.6% of the invested assets are in target date funds. Of all the investors who are offered a target date fund, 20% of them are utilizing at least one target date fund in their HSA portfolios.

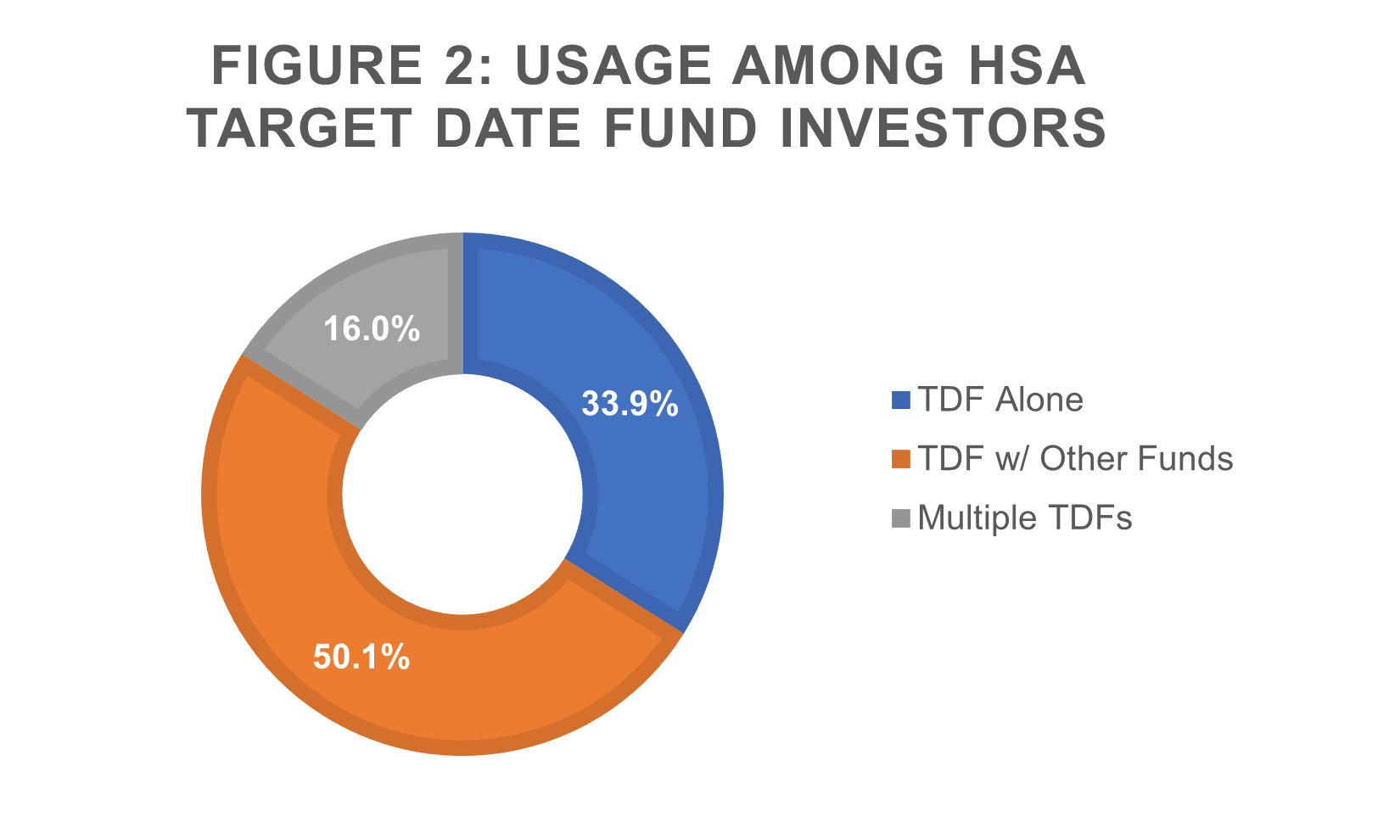

Looking deeper into the 20% of HSA investors using target date funds is quite interesting. One could make the argument that target date funds are designed to be a single fund solution, as in investing in one target date fund is all that is needed to have a properly allocated portfolio. However, we found that nearly two-thirds of target date fund users are either using multiple target date funds or are using a single target date fund along with other mutual funds, as can be seen below in Figure 2.

Note:

- TDF Alone: Investors who hold a single target date fund as the only investment option. Also includes investors who hold a single target date fund and a money market holding.

- TDF w/ Other Funds: Investors who hold a single target date fund along with other mutual funds.

- Multiple TDFs: Investors who hold more than one target date fund in their portfolio. Also includes investors who hold more than one target date fund along with other mutual funds.

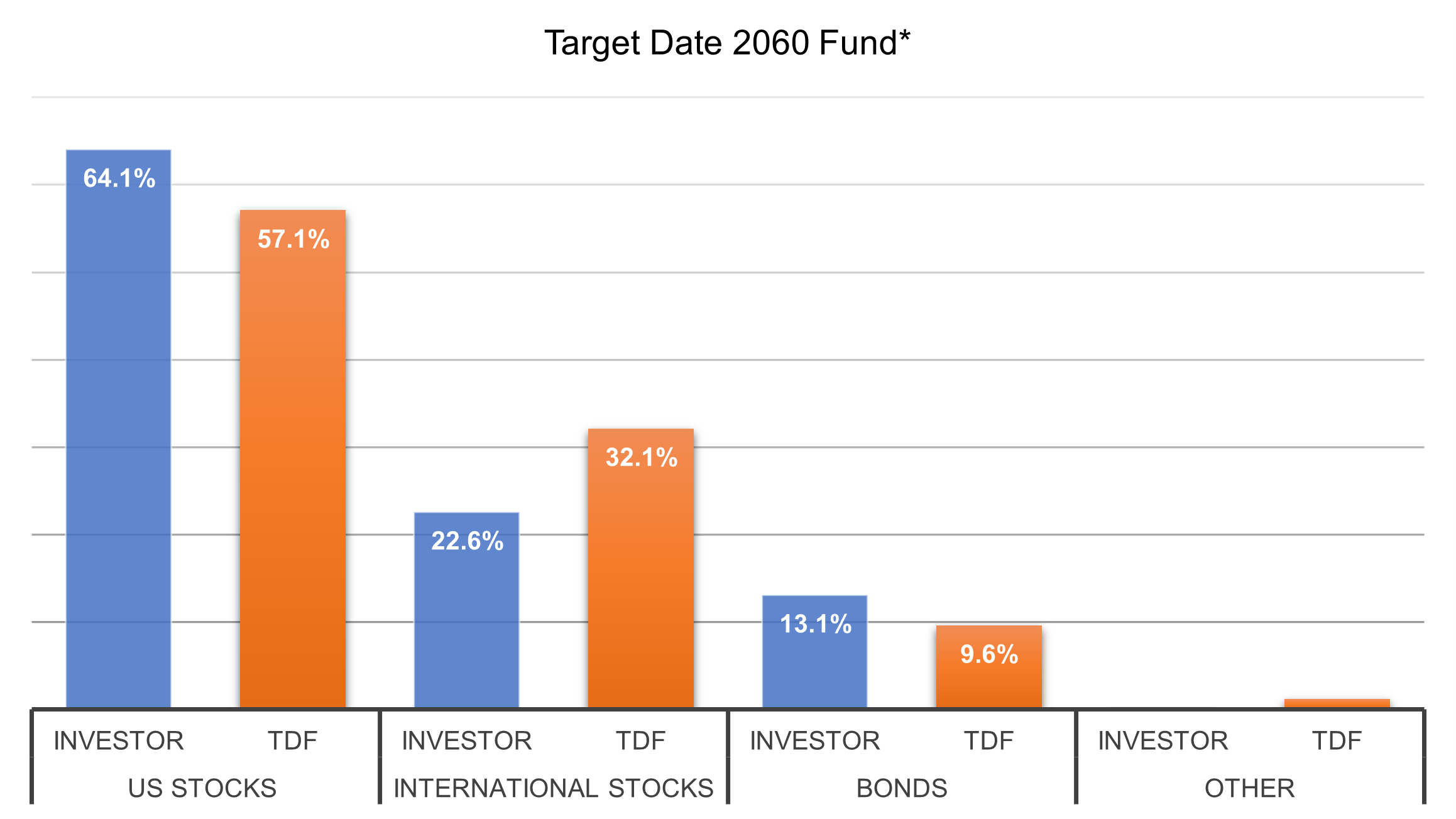

Seeing how HSA investors are using target date funds prompted us to learn more about how these investors’ overall asset allocations compare with the underlying asset allocation of the target date that they are invested in. Mixing target date funds, either with another target date fund or other mutual funds, can often lead to a potentially unintentional concentration in one or more asset classes.

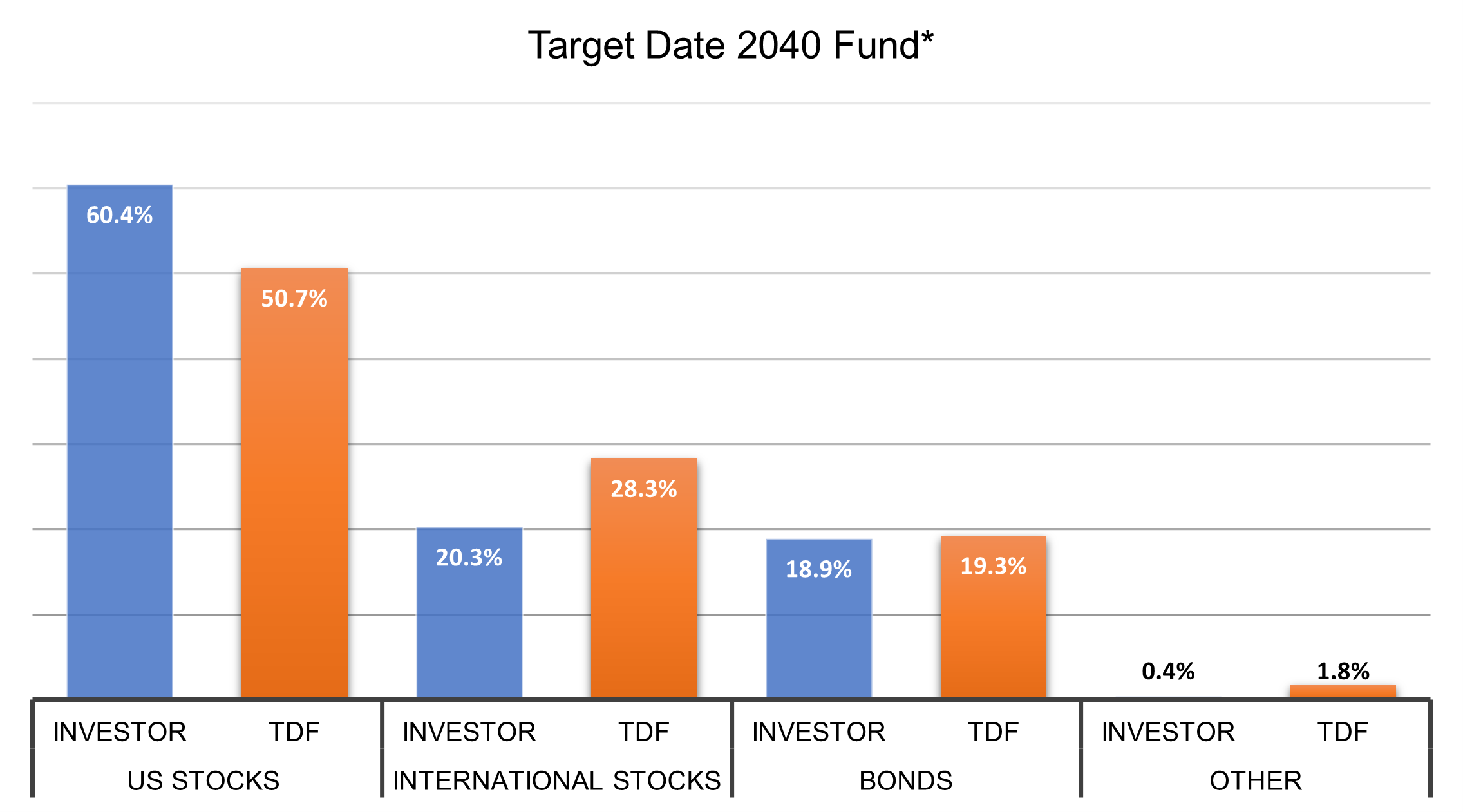

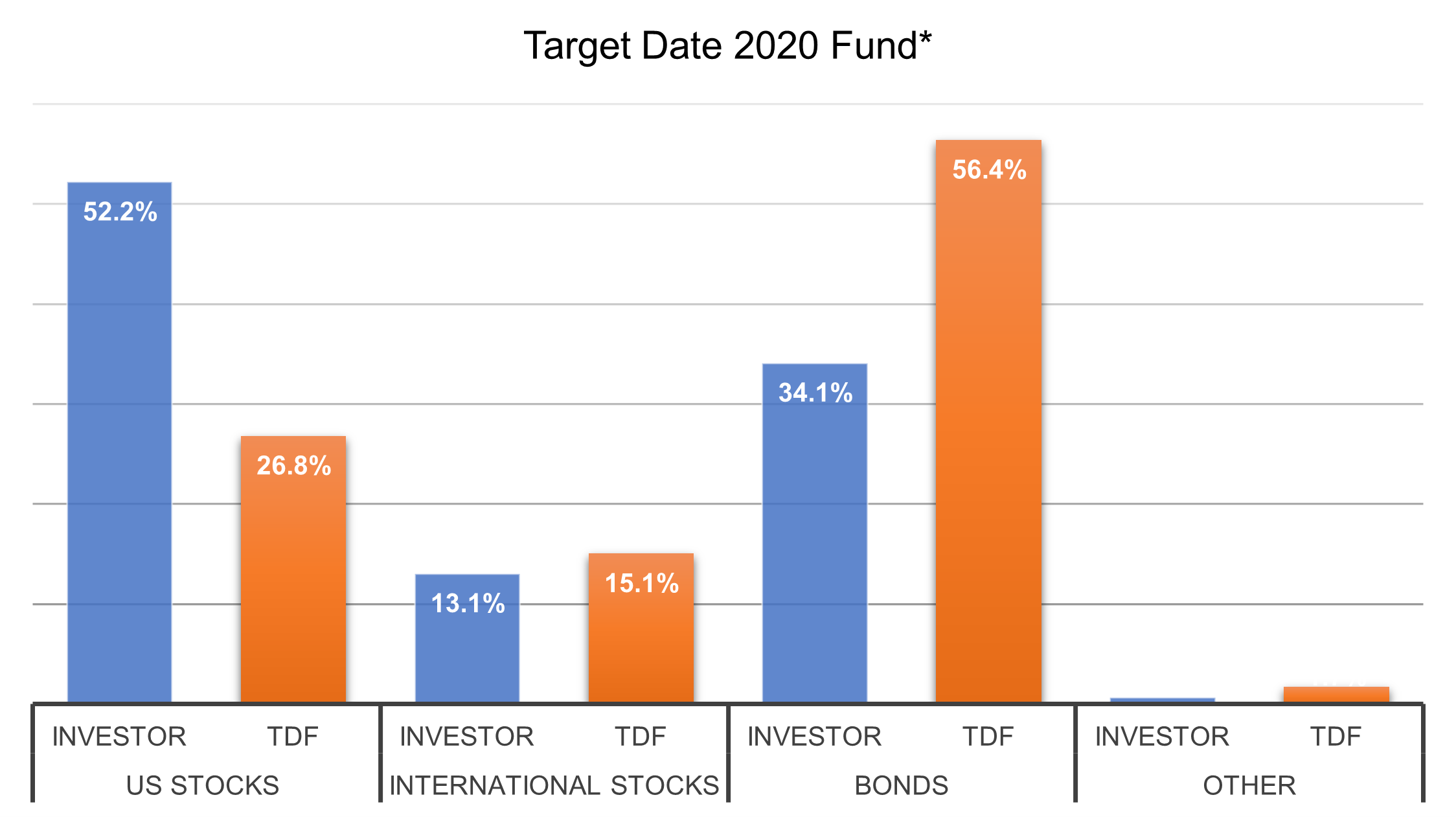

Figure 3 highlights our findings for the 2060, 2040, and 2020 target date funds. The average asset allocation of an investor who holds these target date funds is compared to the underlying average asset allocation of these same target date funds.

Figure 3: HSA Target Date Fund Investor’s Overall Asset Allocation Compared to Underlying Target Date Fund Asset Allocation*

Target Date Funds in HSAs: Pros and Cons

Now that you have some background on target date funds and how they are being used in HSAs, let’s look at some pros and cons of target date funds in HSAs.

Pros

- Low Maintenance: Target date funds are easy solutions for the “Set and Forget” investor.

- Diversification: Target date funds have a built-in diversified asset allocation, typically with exposure to several different asset classes. This allows an investor to easily diversify, even with a lower balance account.

- Rebalancing: Through automatic rebalancing and a gradual transition down the fund’s glide path, target date funds help investors manage risk by maintaining a planned asset allocation.

Cons

- Time Horizon: The intended time horizon of the target date fund (i.e., retirement) may not correspond to the timing of medical expenses. This can lead to an investor having an allocation that is too aggressive.

- Asset Class Concentration: Each target date fund has its own underlying asset allocation, so mixing a target date fund with other funds or other target date funds can lead to an asset allocation that is unintentionally concentrated in one or more asset classes.

- One Size Fits All: Target date funds are often promoted as a one size fits all investment. However, the appropriate investment mix for one investor may not be the same for another investor in the same age range, especially for HSAs when the timing of medical expenses is unknown.

Time Horizon: 401(k) vs HSA

We touched on time horizon briefly in the last section, but as a key difference between the typical 401(k) and HSA investor, this topic deserves more attention.

In most situations, investors cannot access their 401(k) dollars until they’ve reached the age of 59 ½, otherwise they face a 10% early withdrawal penalty. This means the 401(k) investor is less likely to sell their investments before this age. Therefore, the time horizon is known by the investor with some degree of confidence and can lead to a more straightforward portfolio construction process.

Because an investor’s retirement date can be estimated with some degree of certainty, target date funds are typically used as the default investment option for 401(k) plans. When participants enroll in their 401(k) plan, either manually or through auto enrollment, their default option is often the target retirement fund that corresponds closest with the year they will turn 65. This helps certain investors, such as those who may never choose investments at all or who lack the ability, time, or resources to build well-constructed portfolios, maintain a diversified asset allocation and have a better opportunity to grow their retirement dollars.

On the other hand, the time horizon for HSAs is generally unpredictable. Health expenses can occur unexpectedly and can be very costly, which makes planning for future expenses more difficult. This creates the possibility for a mismatch between an investor’s health risk tolerance and their portfolio’s risk. For example, a 31-year-old who plans to retire at age 65 invests in a 2055 target retirement fund, which would likely have an asset allocation around 90% stocks and 10% bonds. While this may be an appropriate allocation for a 30+ year time horizon, it may not be appropriate for dollars that could be needed in the short-term for medical expenses. The investor may experience an unexpected medical event and need to access their HSA dollars during a market pullback, forcing a liquidation of assets at an inopportune time and ultimately locking in losses.

Additionally, electing a default investment option in HSA plans is not as black and white as it seems to be for 401(k)s. There is not a common characteristic between people, such as age used in 401(k)s, that can be used to accurately predict when they may need to access their healthcare dollars because injuries and unexpected illnesses happen. This difference in predictability of expenses is a key reason why the default investment option in HSAs is often a money market fund.

Closing Comments

This research is intended to shed light on how investors are using target date funds in their HSA investments and highlight a few characteristics that may have an impact on the appropriateness of target date funds in HSAs. We at Devenir will continue to monitor this topic and look forward to publishing more insights.

If you have any comments or questions, feel free to contact our research team at [email protected]. To see more HSA related research and content, subscribe to our monthly newsletter below.

References

https://www.sec.gov/comments/4-582/4582-3.pdf

https://www.ici.org/system/files/2021-05/2021_factbook.pdf

https://www.ebri.org/docs/default-source/webinars/tdfwebinar.pdf

*Created using Morningstar data as of 12/31/2021.

Investments are not FDIC/NCUA Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information.