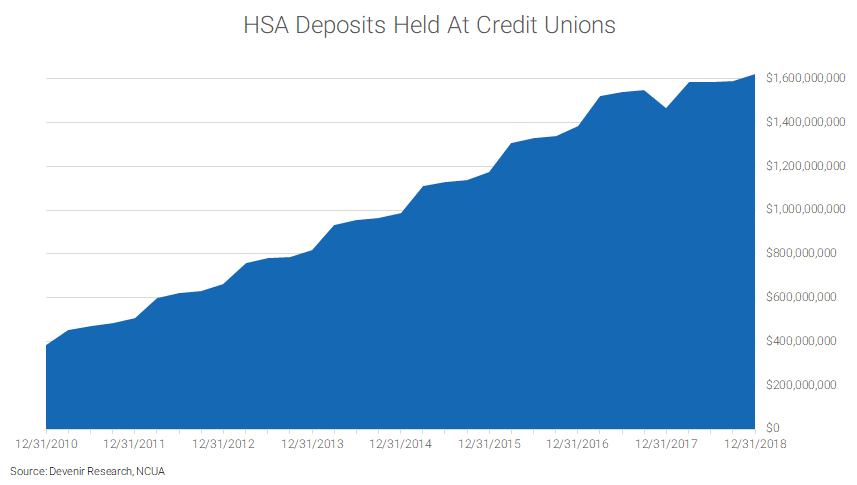

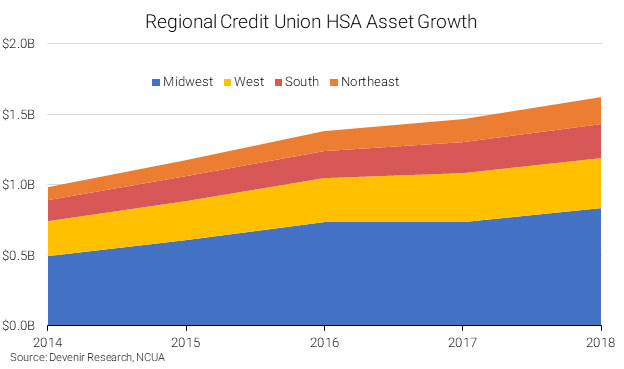

On March 6th we published our latest quarterly analysis of how health savings accounts are faring amongst credit unions. According to the latest NCUA filings, at the end of 2018 credit unions held $1.62 billion in HSA deposits amongst what we would estimate to be roughly 670,000 accounts.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

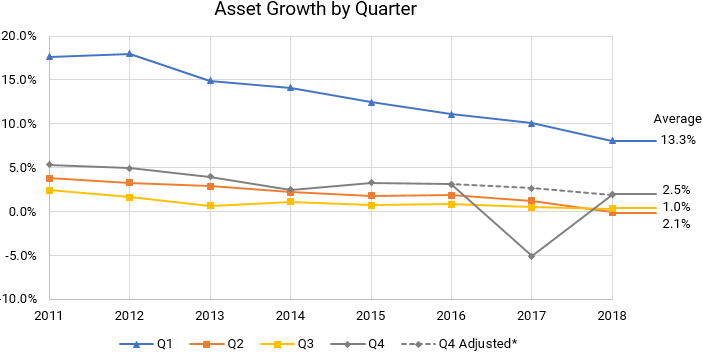

Credit Union assets were up 10.4%, trailing the 19.0% growth of the overall market. HSA asset growth among credit unions (and the broader HSA market) has been historically cyclical with employers often funding accounts at the beginning of the year.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

* Q4 Adjusted assumes Alliant Credit Union’s Q4-2017 HSA asset growth is equal to their 3-year Q4 average.

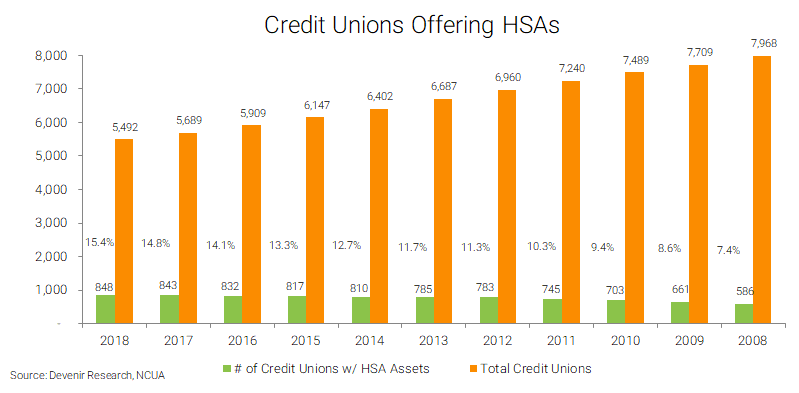

As consumer and employer demand for HSAs increases, more credit unions have begun to offer them. At the end of 2018, 848 of the 5,492 NCUA credit unions held HSA deposits.

Of those credit unions holding HSA deposits as of 12/31/18, 67 held over $5 million in HSA deposits and 242 held over $1 million in HSA deposits.

| Number of NCUA Credit Unions With… | |

|---|---|

| Over $5 Million in HSA Deposits: | 67 |

| Over $1 Million in HSA Deposits: | 242 |

| Over $500,000 in HSA Deposits: | 344 |

| With HSA Deposits: | 848 |

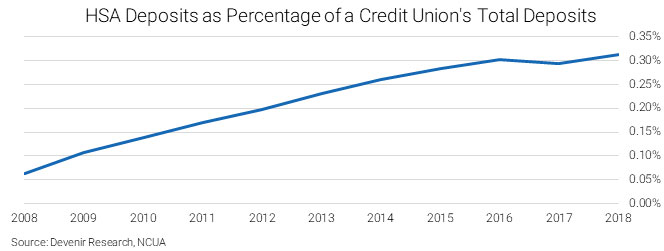

While the growth of HSAs has been exciting and promising, they still represent a small portion of the typical HSA credit union asset base. At the end 2018, HSA deposits only represented on average 0.31% of total deposits for those credit unions offering health savings accounts.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

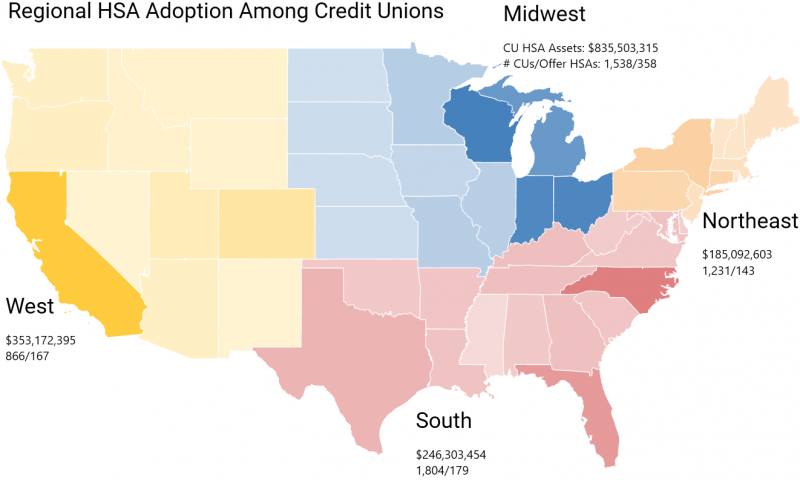

We have increasingly seen credit union HSA adoption vary by geography with the Midwest adopting at a higher rate than the rest of the US. This is shown in the chart below with the darkest states representing a larger HSA asset pool among credit unions.

We continue to be interested in HSA adoption amongst credit unions and will continue to report on NCUA filings on a quarterly basis. Thank you for reading and feel free to reach out to our research team at [email protected] if you have any questions or thought’s you’d like to share!