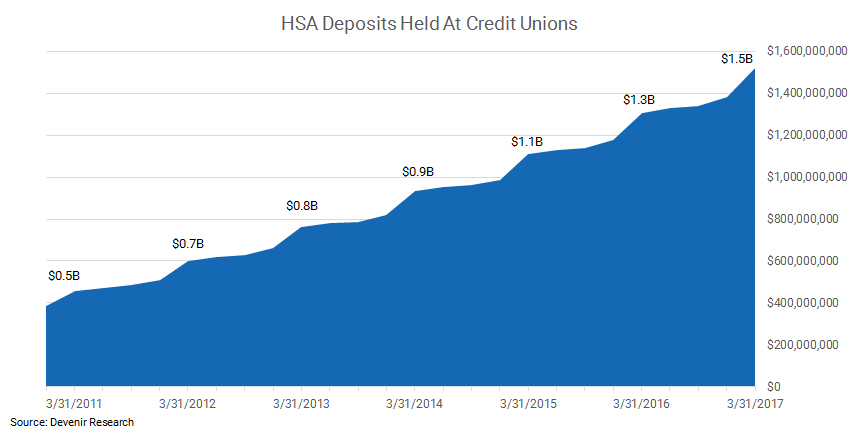

We published our latest quarterly analysis of how health savings accounts are faring amongst credit unions and it appears credit unions are continuing to contribute to the overall growth of the HSA market. According to the latest NCUA filings, as of March 31, 2017 credit unions held $1.52 billion in HSA deposits amongst, by our estimate, over 600,000 accounts.

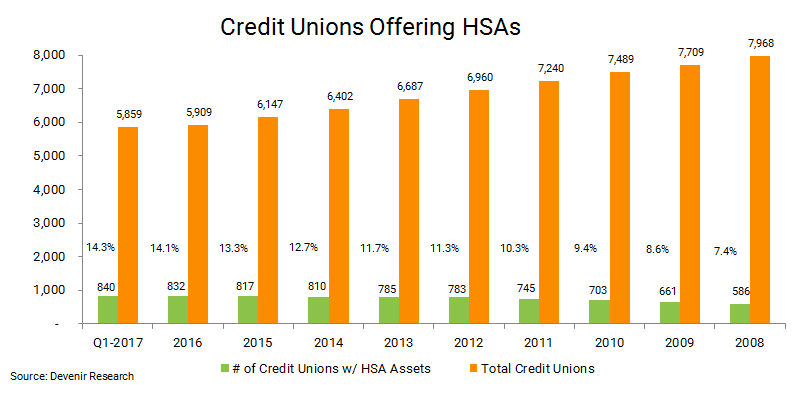

With more attention being drawn to the opportunity HSAs present, both for consumers and financial institutions, more credit unions have begun to offer them. At the end of the Q1-2017, 840 of the 5,859 NCUA credit unions held HSA deposits.

Of those credit unions holding HSA deposits as of 3/31/17, 225 held over $1 million in HSA deposits and 61 held over $5 million in HSA deposits.

| Number of NCUA Credit Unions With… | |

|---|---|

| Over $5 Million in HSA Deposits: | 61 |

| Over $1 Million in HSA Deposits: | 225 |

| Over $500,000 in HSA Deposits: | 322 |

| With HSA Deposits: | 840 |

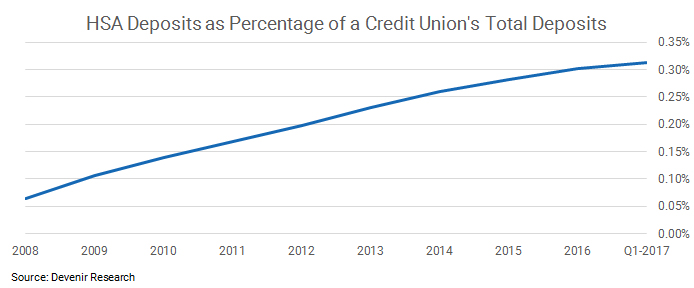

While the growth of HSAs has been exciting and promising, they still represent a small footprint when looking at a typical credit union’s entire footprint. At the end of Q1-2017, HSA deposits only represented on average 0.31% of a credit union’s total deposits for those credit unions with health savings accounts.

We continue to be interested in HSA adoption by credit unions and will continue to report on NCUA filings on a quarterly basis. Thank you for reading. Feel free to reach out to our research team at [email protected] if you have any questions or thought’s you’d like to share!