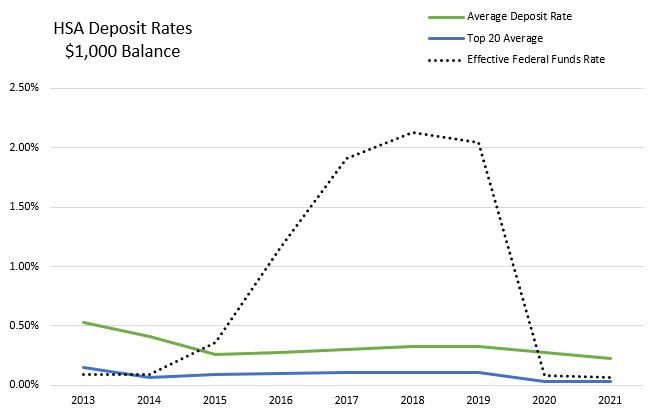

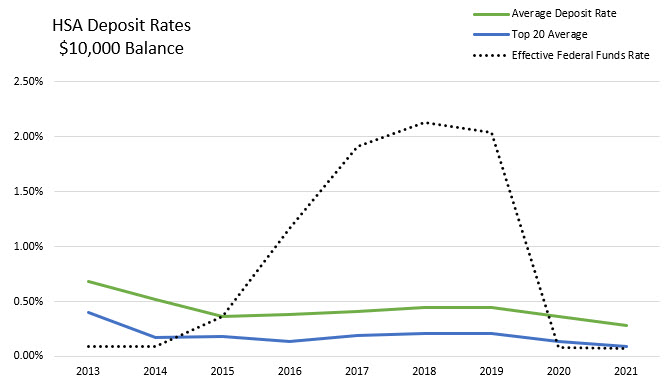

On February 23rd and 24th, Federal Reserve Chairman Jerome Powell testified before Congress that the Federal Reserve does not plan to change their current monetary policy in the near term. In March of 2020, the Federal Reserve lowered interest rates at the onset of the COVID-19 pandemic and this most recent announcement signals that we can expect to remain in a low interest rate environment for the immediate future. Since the onset of the pandemic, consumers have seen the effect of these decisions on their bank deposits. The average deposit rate, for an account holder with $1,000 in their health savings account (HSA) has dropped 10 basis points since 2019. During the same period and balance level, the average rate at the twenty largest HSA providers has dropped 8 basis points. Over the past few years, health savings accounts have experienced more variation in their deposit rates than regular savings accounts and the average deposit rates at the top 20 providers remain lower compared to the broader market.

Source: Devenir Research, FRED Economic Database

*Data used for 2015 and 2017 was interpolated.

Devenir will continue to monitor how interest rates are affected by the speed of the economic recovery and we look forward to sharing more insights! If you found this helpful, you can get more content like this by subscribing to our monthly newsletter below.

Note: Data above represents Devenir’s assessment on readily available public data. For specific interest rates that apply to your HSA, please contact your HSA provider.