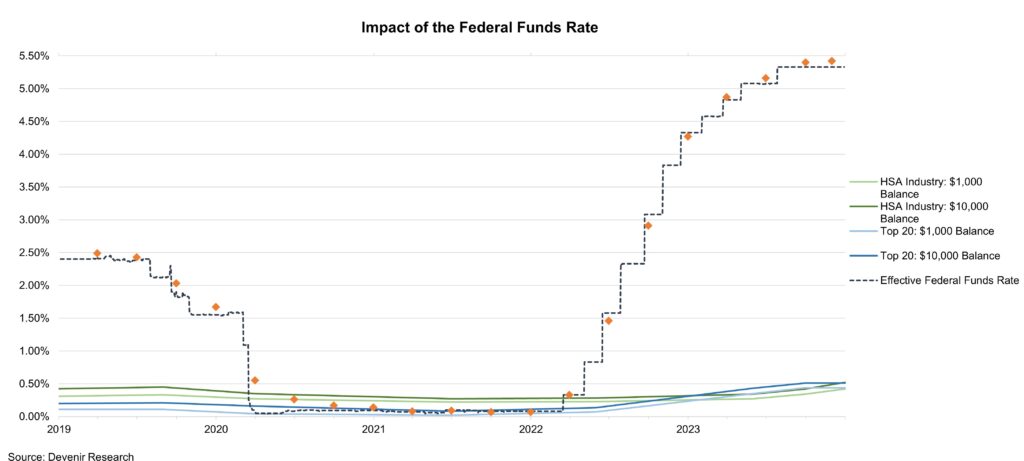

The 2023 calendar year wrapped up with three consecutive FOMC meetings all resulting in an unchanged federal funds rate that sits in the range of 5.25% – 5.50%. The latest commentary and projections from the Fed have turned more dovish to end the year and have signaled that the hiking cycle is likely over and that rate cuts are possible later in 2024. However, any moves will continue to be highly dependent on inflation and other economic data.

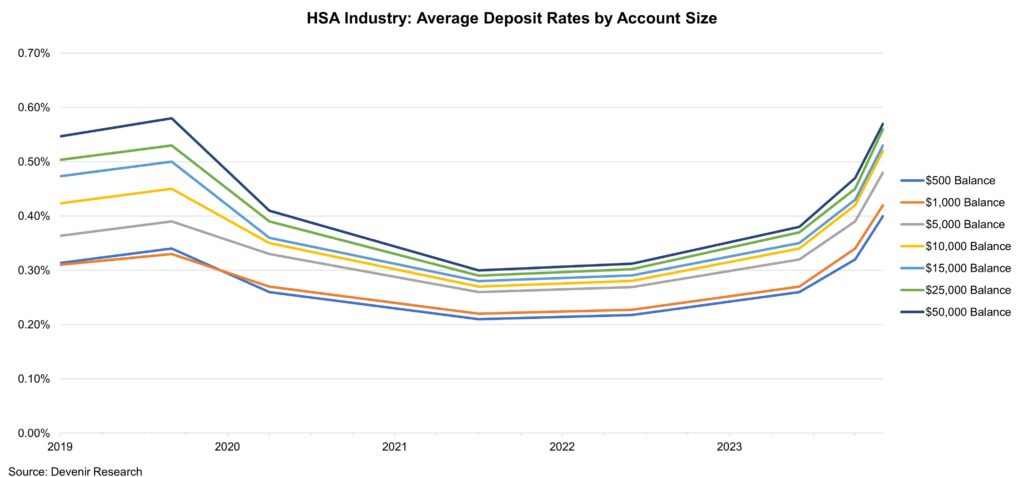

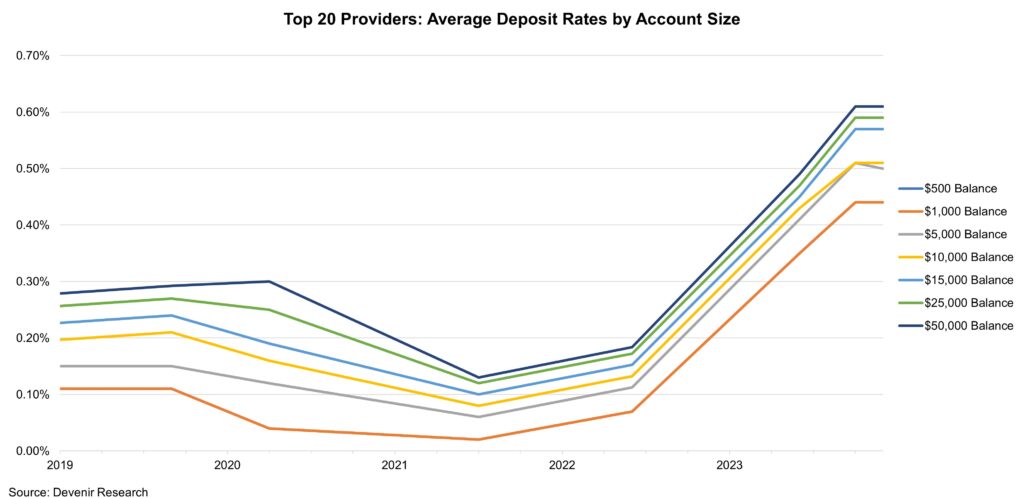

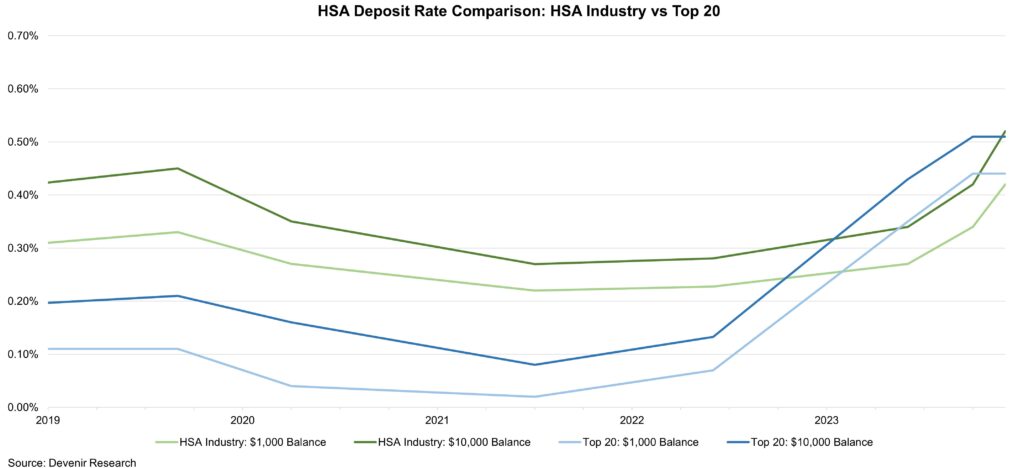

The rapid rise in the federal funds rate over the course of 2022 and 2023 has resulted in continued increases in the average rate paid on HSA deposit balances. As of December 31st, 2023, HSA providers are paying an average rate of 0.42% at the $1,000 balance threshold, an increase of 8 basis points from September 2023. At the $10,000 balance threshold, the average rate is up to 0.52%, an increase of 10 basis points from September 2023. As a reminder, HSA providers often have tiered rate schedules where higher balance accounts are offered higher rates, so the effective annual percentage yield (APY) received by an accountholder is typically a blended APY.

We have also been tracking money market fund data as investors might use them either as an alternative to the HSA deposit account or in addition to the deposit account. As of the end of November 2023, the asset-weighted seven-day yield of government money market funds was 5.42%.

Note: The money market fund yield is based on the asset-weighted 7-day yield of government money market funds.

Source: FRED Economic Database, U.S. Securities and Exchange Commission

We will continue to monitor HSA deposit rates throughout the industry and look forward to sharing these insights.

Note: Data above represents Devenir’s assessment of readily available public data. For specific interest rates that apply to your HSA, please contact your HSA provider.

References

- U.S Securities and Exchange Commission. 2023. “Money Market Fund Statistics”.

https://www.sec.gov/files/mmf-statistics-2023-11.pdf