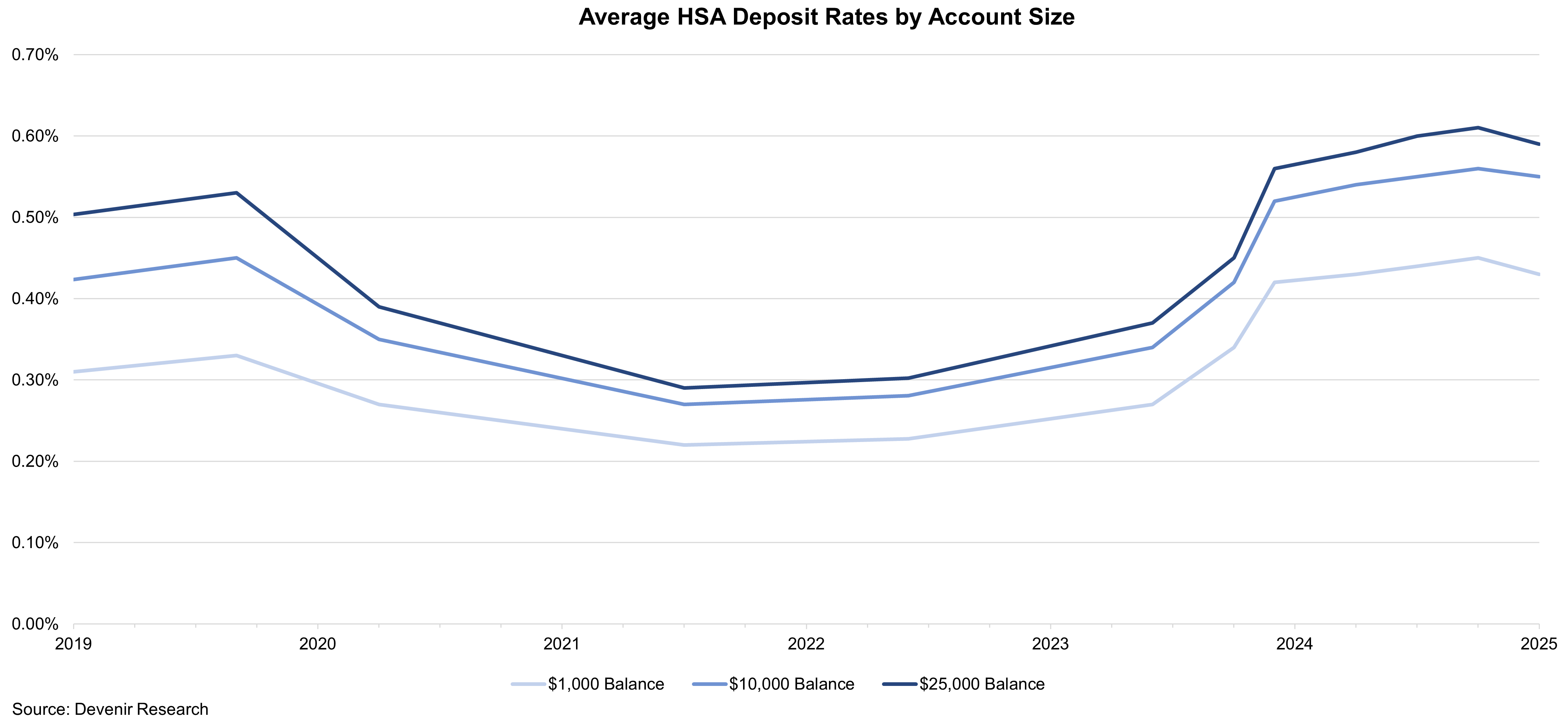

New data from HSA Search indicates that HSA deposit rates, after climbing steadily for much of 2023 and 2024, have begun to retreat from their recent highs. For instance, on September 30, 2024, $50,000 balances averaged 0.63%, down to 0.61% by December. This two-basis-point decrease may represent a pause in HSA interest rate increases or the beginning of longer term HSA interest rate decline.

These shifts coincide with the Federal Reserve’s more accommodative stance. After peaking at 5.33% in the summer of 2023, the Effective Federal Funds Rate (EFFR) eased to 4.33% by the end of 20241. While this is still relatively high compared to pandemic levels, the downward path appears to be giving some HSA providers a reason to pause on further deposit rate increases.

Looking ahead, HSA providers will likely continue adjusting deposit rates in response to multiple forces — competition for account holders, funding costs, and the Fed’s evolving policies. For employers and account holders, this means paying closer attention to rate updates, particularly as economic conditions remain fluid.

Note: The above reflects Devenir’s summary of publicly available data. We encourage readers to confirm specific rates with individual HSA providers, as offerings can differ significantly and change without notice.

References

- Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, January 17, 2025