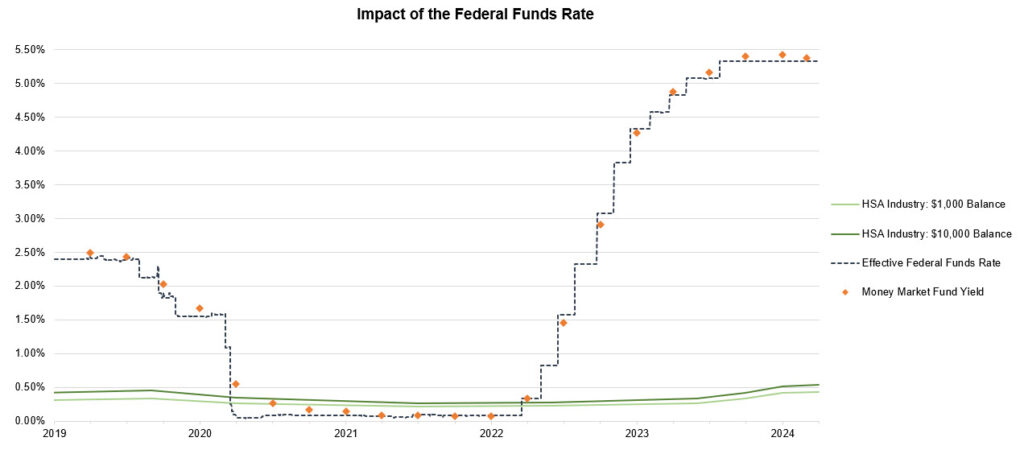

The Federal Reserve held the federal funds rate constant throughout the first quarter of 2024 and has now held rates steady in five consecutive meetings. The range for the federal funds rate is currently 5.25% to 5.50%. Commentary from the Fed continues to suggest that the policy rate has peaked for this hiking cycle, however, questions remain about the timing and extent of any potential rate cuts. The latest projects from the Fed’s March FOMC meeting indicate that they expect 75 basis points of rate cuts during 2024. The Fed continues to emphasize that any moves in the policy rate will be highly dependent on economic data and that they must have greater confidence that inflation is on a sustainable path to their 2% target.

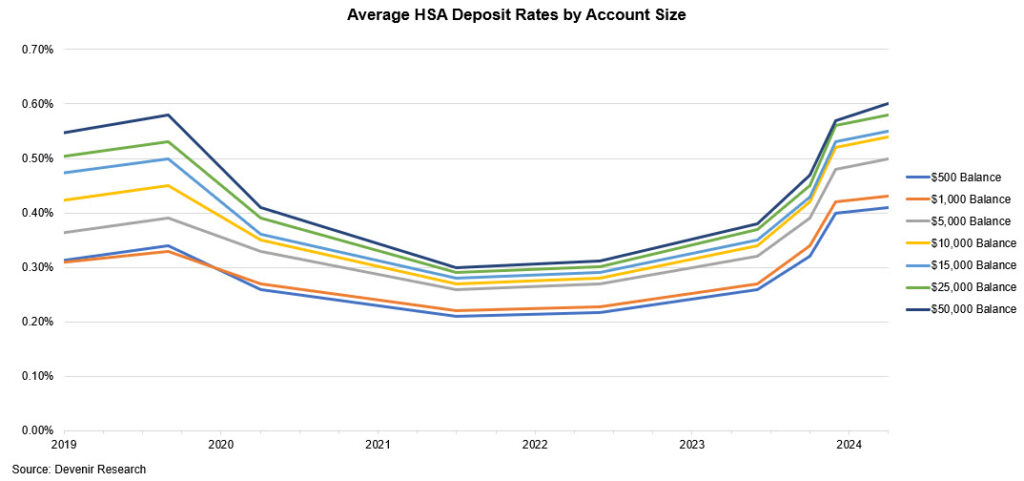

Over the last couple of years, we have seen HSA deposit rates move up from the lows in 2021. As of March 31st, 2024, HSA providers are paying an average rate of 0.43% at the $1,000 balance threshold, an increase of 1 basis point from December 2023. At the $10,000 balance threshold, the average rate is up to 0.54%, an increase of 2 basis points from December 2023. As a reminder, HSA providers often have tiered rate schedules where higher balance accounts are offered higher rates, so the effective annual percentage yield (APY) received by an accountholder is typically a blended APY.

We have also been tracking money market fund data as investors might use them either as an alternative to the HSA deposit account or in addition to the deposit account. As of the end of February 2024, the asset-weighted seven-day yield of government money market funds was 5.38%.

Note: The money market fund yield is based on the asset-weighted 7-day yield of government money market funds.

Source: FRED Economic Database, U.S. Securities and Exchange Commission

We will continue to monitor HSA deposit rates throughout the industry and look forward to sharing these insights.

Note: Data above represents Devenir’s assessment of readily available public data. For specific interest rates that apply to your HSA, please contact your HSA provider.

References

- U.S Securities and Exchange Commission. 2024. “Money Market Fund Statistics”.

https://www.sec.gov/files/investment/mmf-statistics-2024-02.pdf