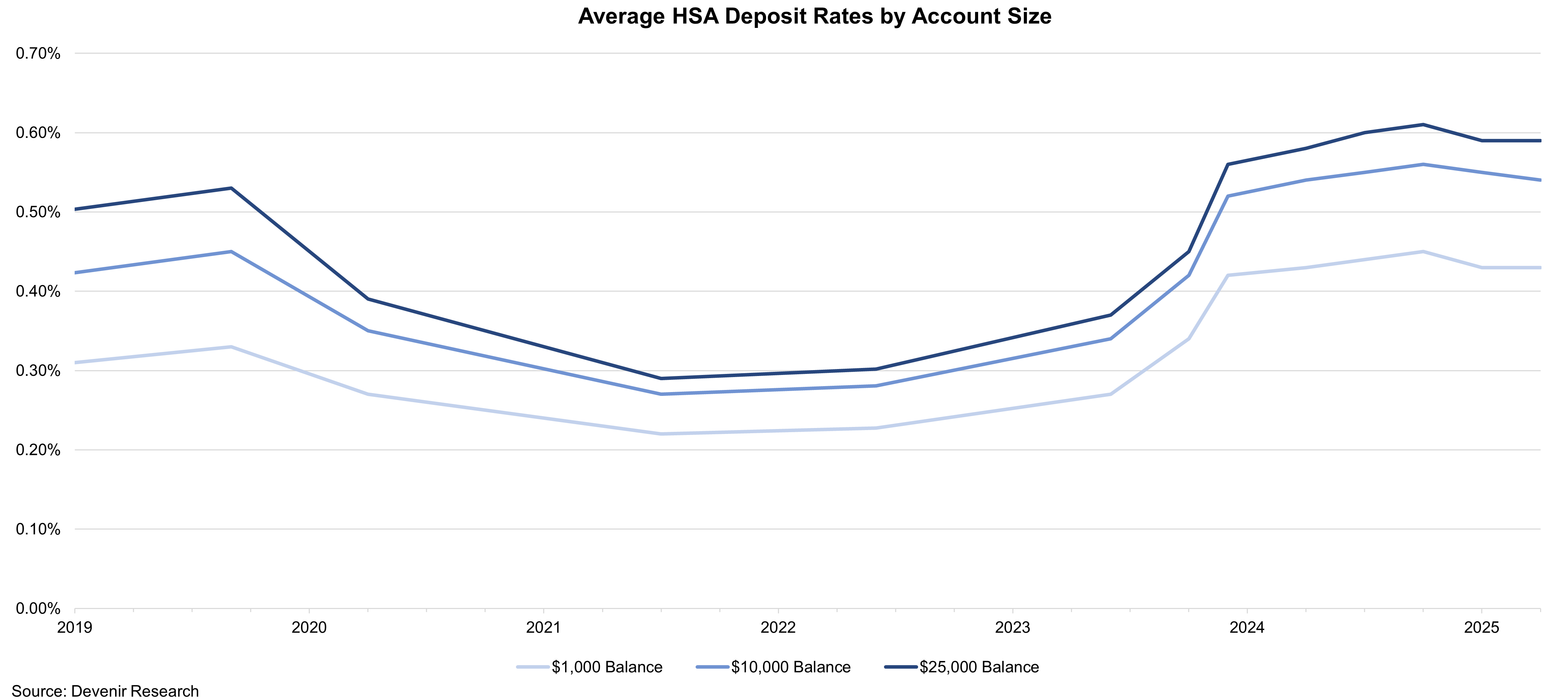

New data collected from HSA Search last quarter showed that HSA deposit rates were basically unchanged after climbing steadily in 2023 and 2024. Both the $1,000 and $25,000 balance were unchanged, while the $10,000 balance dipped slightly from 0.55% on December 31, 2024 to 0.54% at the end of March in 2025. With the slight decrease or no change in HSA deposit rates, rates appear to have leveled off and may start to pull back.

Observations in HSA deposit rates coincide with the Federal Reserve’s decision to keep rates unchanged during Q1 2025. The Effective Federal Funds Rate (EFFR) remained at 4.33%1. This continues to be higher than in the last several years. HSA providers are likely to hold deposit rates in conjunction with the Federal Reserve’s outlook unless the economy drastically changes.

However, HSA providers will continue to monitor their deposit rates for several reasons — attracting new account holders, staying competitive for existing account holders, fluctuating funding costs, and as the Fed’s policies evolve. For employers and account holders, this means paying closer attention to rate updates, particularly as economic conditions remain fluid.

Note: The above reflects Devenir’s summary of publicly available data. We encourage readers to confirm specific rates with individual HSA providers, as offerings can differ significantly and change without notice.

References

- Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, April 4, 2025