With the next installment in our 3-part blog series we cover another important difference between investing in an HSA and 401(k). Part 1 pointed out the flexibility of HSAs and detailed the primary uses of the account. In this post we look at both accounts through an investment lens and how retirement with a healthcare focus can affect investing.

Reason 2: Healthcare costs can be unpredictable.

How you plan to use your HSA (spender, saver, investor) can have a drastic impact on your savings goals. For example, a spender may anticipate saving for a single year’s health costs, where an investor may be saving for 15+ years of health costs. Longer time horizons probably allow for some reversion to the mean making health costs easier to predict, but what if an HSA investor suddenly incurs a large medical expense and cannot afford to pay out of pocket? How will using an HSA in this scenario affect their savings plan? All else constant, these are things 401(k) investors likely don’t need to think about unless the medical expense is so significant they are forced to withdraw funds from the 401k to cover it.

HSAs differ from 401(k)s in setting savings goals as HSA distributions are tied to individual or family healthcare costs, whereas 401(k) distributions are primarily used for retirement income. This means 401(k)s have a fairly-identifiable window of time you can expect to withdraw money. The popularity of investment products tied to a “target date” support this idea as they provide investors an easy way to “set and forget” their retirement portfolio. In contrast, distributions from HSAs may be less predictable. Though medical expenses generally go up with age, year to year costs may vary significantly both pre-and post-retirement. As a result, HSAs often require a minimum deposit balance before investing so investors have a safety net should they incur any unexpected costs. For an HSA investor, this safety net of deposits can be helpful during periods where investments perform poorly, and healthcare costs increase.

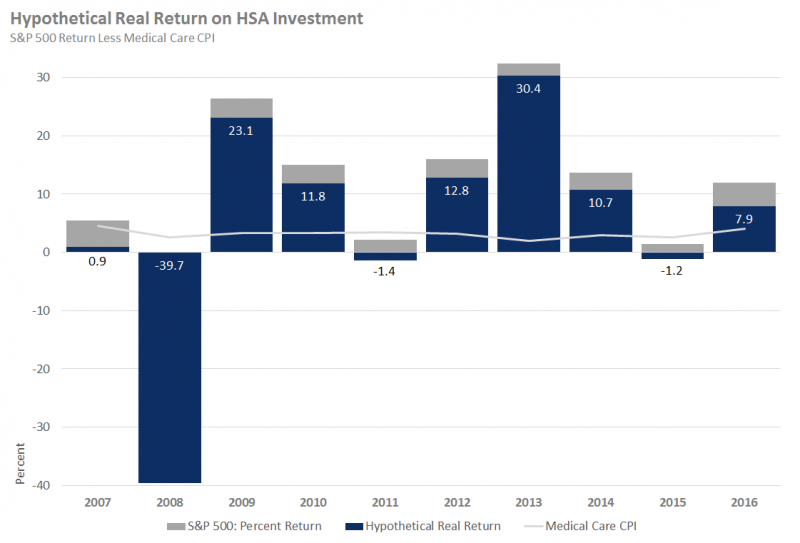

Investing within an HSA gives accountholders a tool to potentially counter rising costs over the long run, but with added risk. If an HSA is used solely for qualified medical expenses (QME), it can be helpful to consider the real return of investment in an HSA1. That is, the difference between the return in the HSA and the % increase in the amount consumers pay for healthcare; or healthcare inflation.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|

| S&P 500 | 5.5% | -37.0% | 26.5% | 15.1% | 2.1% | 16.0% | 32.4% | 13.7% | 1.4% | 12.0% |

| Medical Care CPI | 4.6% | 2.7% | 3.4% | 3.3% | 3.5% | 3.2% | 2.0% | 3.0% | 2.6% | 4.1% |

| Hypothetical Real Return | 0.9% | -39.7% | 23.1% | 11.8% | -1.4% | 12.8% | 30.4% | 10.7% | -1.2% | 7.9% |

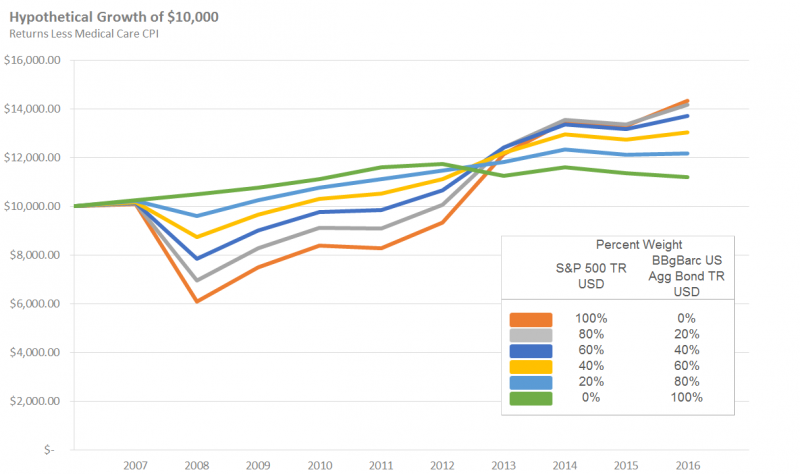

Assuming the HSA is used for QME, inflation can eat away at the buying power of the balance. In 2008, 2011 and 2015 the real return of an HSA investor fully invested in the S&P 500 Index would have been negative due to rising medical costs. Considering some point along the line investors will likely need to tap into their investment balance to cover an unexpected cost, real return can be a useful tool when making savings decisions. Those who choose to invest in an HSA may benefit from tools and allocators that simplify investment decisions and help accountholders choose investments that align with their risk tolerance. The chart below2 shows how various investment styles have fared in the past after adjusting for healthcare inflation.

HSA investors have some additional factors to consider when making savings decisions that 401(k) investors may not. Year to year variance in health costs are a reason for investors to pay attention to their investments and for providers to offer an assortment of tools in an investment solution. Next up, we will cover the developments of the HSA marketplace compared to the 401(k) marketplace.

Stay tuned for the final segment of our HSA vs. 401(k) blog series!

Investments are not FDIC Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information. This information may be affected by the laws of particular states and there is no guarantee this information will be consistent across all states. Alabama, California, and New Jersey may impose taxes on HSA contributions, earnings, and dividends. Additionally, New Hampshire may impose taxes on HSA contributions. All data used are estimates and may not reflect actual observed data. Medical CPI is an index used to measure price levels of general medical costs and does not necessarily include all HSA qualified medical expenses.

End Notes

1 Sources: Morningstar, Bureau of Labor Statistics. Data Includes: S&P 500 Index, Medical Care CPI.

2 Assumes investor return is equal to the Index as listed in the legend. It may not be possible to replicate such returns due to fees and other considerations. For educational purposes only, not to be construed as investment advice. Consult a financial professional when making investment decisions. Source: Morningstar, Bureau of Labor Statistics. Data Includes: S&P 500 Index, BBgBarc US Agg Bond Index, Medical Care CPI. Investment Style represents a mix of weights to the S&P 500 Index and the BBgBarc US Agg Bond Index, for example “100/0” represents a 100% weight to the S&P 500 Index and a 0% weight to the BBgBarc US Agg Bond Index.