We recently published a white paper sharing some of our views on HSA investment menu design. As a follow up to that piece, we thought it would be interesting to compare past and present HSA investment menus and see if there are any noticeable trends taking place on an industry-wide level. We looked at provider fund lineups as of 12/31/2022 and then went back 5 and 10 years for comparison. This post takes a look at some of the things that stood out to us.

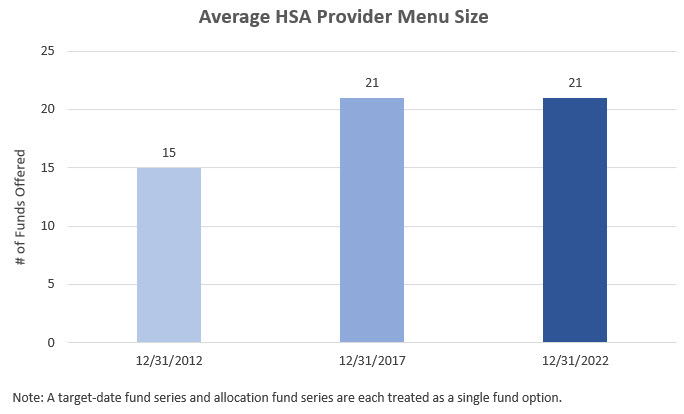

Menu Size

We believe the ideal menu size is between 15 to 30 funds, where the right menu size for a provider will vary based on several different factors. As a reminder, for this analysis we count a target-date fund series and an allocation fund series each as a single option. The average number of funds offered grew from 15 funds in 2012 to 21 funds in 2017 and currently remains at 21 funds.

Source: Devenir Research

Source: Devenir Research

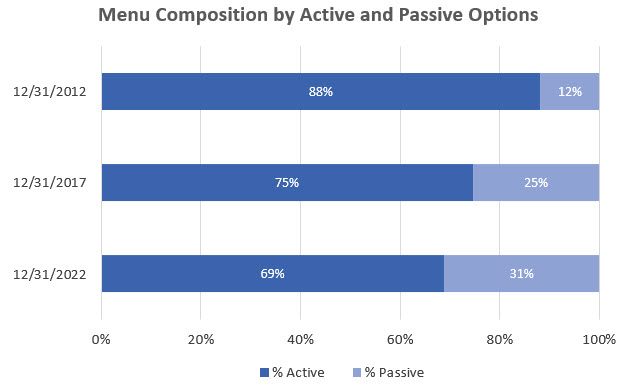

Active vs Passive Options

The active vs passive topic is highly debated in the financial services industry. We believe it is best to offer a mix of active and passive funds because results can vary by asset class and history suggests that the relationship between active and passive may be cyclical1. In addition, providing both options can be helpful for satisfying various investor preferences. There is a noticeable trend in the active and passive split of investment menus over time. Compared to the past, passive options are now much more common and make up 31% of menus on average as of 12/31/2022.

Source: Devenir Research

Source: Devenir Research

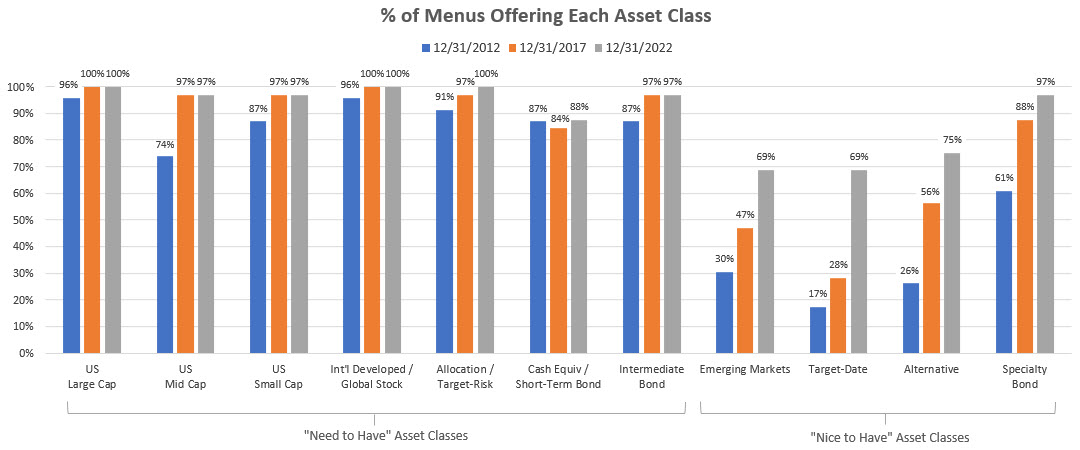

Asset Classes

In our white paper we lay out a basic prioritization of asset classes to consider when constructing an investment menu. There are several “Need to Have” asset classes that are required to build out a well-rounded portfolio and additional “Nice to Have” asset classes that may be offered as menu size and complexity increases. Over time, we have seen a noticeable increase in the percentage of investment menus offering these “Nice to Have” asset classes.

Source: Devenir Research

Source: Devenir Research

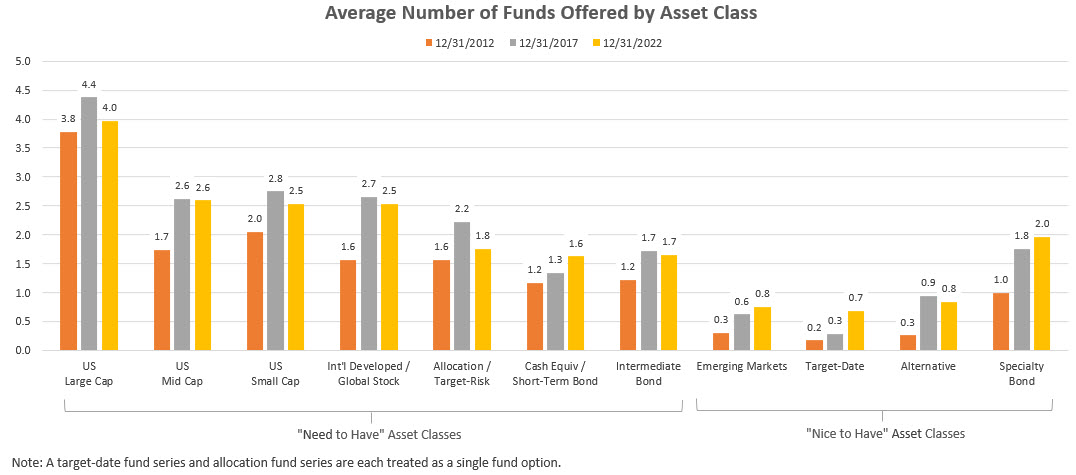

Additionally, as the average menu size grew from 2012 to 2017, every asset class saw an increase in the average number of funds offered. However, from 2017 to 2022, a period where the average menu size remained fairly constant, the average number of funds offered in most “Need to Have” asset classes either decreased or was little changed. During the same period, all “Nice to Have” asset classes saw an increase in the average number of funds offered, except for the Alternative asset class. We believe a focus on reducing menu overlap and broadening asset class coverage may be a couple reasons behind these shifts.

Source: Devenir Research

Source: Devenir Research

Target-Date Funds

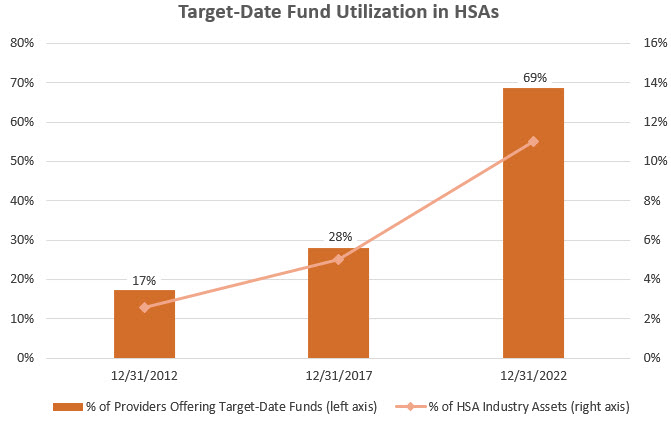

We consider target-date funds a “Nice to Have” asset class for HSAs, mainly because HSA withdrawal patterns are generally less predictable than for a 401(k) and the target-date fund glidepath may not provide a suitable asset allocation for HSA investors needing to make an unexpected withdrawal. In the past, target-date funds were not very common in HSA investment menus as just 17% of providers offered them in 2012. But popularity has picked up and now 69% of providers are offering target-date funds. In addition, target-date funds are being utilized more now by HSA investors as they account for 11% of industry assets as of 12/31/20222, up from 3% at the end of 20123. The growth in popularity could in part be due to familiarity and ease of use, as well as many investors using HSAs to save for healthcare expenses in retirement.

Source: Devenir Research, 2012 Year-End Devenir HSA Research Report, 2017 Year-End Devenir HSA Research Report, 2022 Year-End Devenir HSA Research Report

Source: Devenir Research, 2012 Year-End Devenir HSA Research Report, 2017 Year-End Devenir HSA Research Report, 2022 Year-End Devenir HSA Research ReportInvestment menus have certainly changed quite a bit over the last decade. We have seen menus grow larger and offer a wider variety of options and have seen an increase in the utilization of passive options and target-date funds. We will continue to track menu design throughout the industry and look forward to sharing more insights on this topic.

References

- Hartford Funds. 2023. “The Cyclical Nature of Active & Passive Investing”.

https://www.hartfordfunds.com/insights/market-perspectives/equity/cyclical-nature-active-passive-investing.html - Devenir Research. 2023. “2022 Year-End Devenir HSA Research Report”.

https://www.devenir.com/research/2022-year-end-devenir-hsa-research-report/ - Devenir Research. 2013. “2012 Year-End Devenir HSA Research Report”.

https://www.devenir.com/research/2012-year-end-devenir-hsa-research-report-executive-summary/