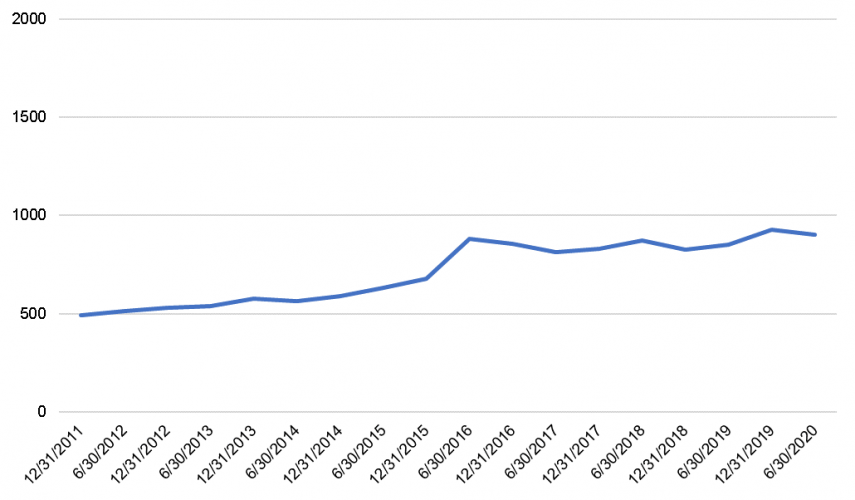

The HSA marketplace consists of providers from a variety of backgrounds from health plans, banks & credit unions, to technology providers. In addition to the wide range of business models, HSA providers come in many sizes as well. One of the ways we measure the impact that provider size has on the concentration in the industry is the Herfindahl–Hirschman Index (HHI).

The HHI is calculated by squaring the market share of each firm competing in the market and then summing the resulting numbers. For example, for a market consisting of four firms with shares of 30, 30, 20, and 20 percent, the HHI is 2,600 (302 + 302 + 202 + 202 = 2,600).

The HHI approaches a maximum of 10,000 as the market grows more top-heavy and decreases if assets become more evenly distributed across market participants.

| HHI Index (Max 10,000) |

|---|

| 0-1,000 – Competitive |

| 1,000-1,500 – Minor concentration |

| 1,500-2,000 – Concentrated |

| 2,000+ – Heavily concentrated |

(Measured by “HHI” using the top 20 HSA providers)

By this measure, we see the HSA industry as highly competitive among the top HSA providers, though growing more concentrated over time. Consolidation throughout the industry is one possible explanation for this trend, as larger providers have selectively used acquisitions as part of their strategy. Interestingly, the marketplace HHI has remained steady over the last several years. However, macroeconomic factors such as a historically low federal funds rate and a weaker job market may support the case for future consolidation, potentially driving concentration higher.

Note: Data above includes Devenir’s proprietary research data and assessments on readily available public data.