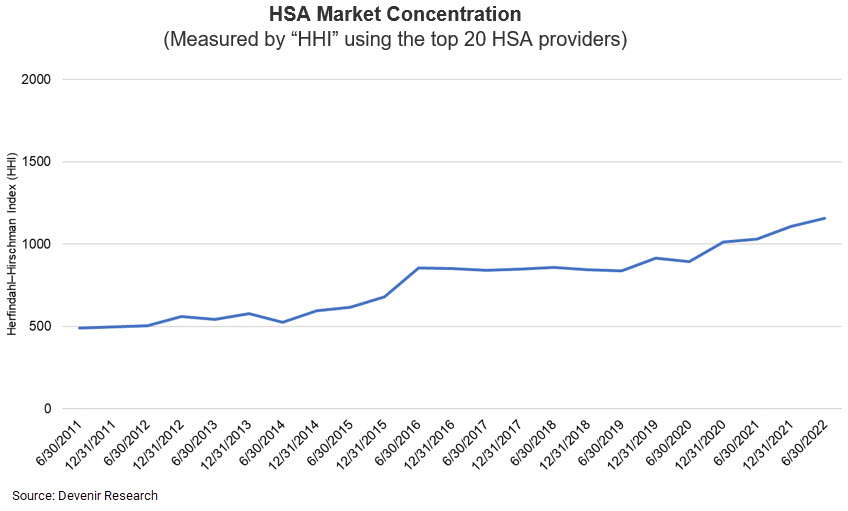

In September 2020, we published a blog post on HSA market concentration. Market concentration was measured using the Herfindahl-Hirschman Index (HHI) and the market shares (as measured by total assets) of the top 20 HSA providers. As a reminder, the HHI is calculated by squaring the market share of each firm competing in the market and then summing the results. For example, for a market consisting of 4 firms with shares of 30, 30, 20, and 20 percent, the HHI is 2,600 (302 + 302 + 202 + 202 = 2,600). A higher HHI generally indicates a higher level of concentration and a less competitive market.

At the time the blog post was first published, the HHI of the top 20 HSA providers was just under 1,000, signaling a competitive market. However, since then, there have been several acquisitions in the HSA market and as a result, we wanted to recalculate the HHI using data from our 2022 Midyear HSA Research Report.

| HHI Index (Max 10,000) |

|---|

| 0-1,000 – Competitive |

| 1,000-1,500 – Minor concentration |

| 1,500-2,000 – Concentrated |

| 2,000+ – Heavily concentrated |

The chart shows us that the HSA market is slowly becoming more concentrated over time with the latest HHI measure indicating minor concentration as some of the top providers continue to gain market share. In fact, the share of the top 5 providers has grown from 60% to 69% of total HSA assets from June 2020 to June 2022, respectively.

We at Devenir will continue to monitor the ever-changing competitive landscape of the HSA market and look forward to providing additional insights. If you have any comments or questions, feel free to contact our research team at [email protected].