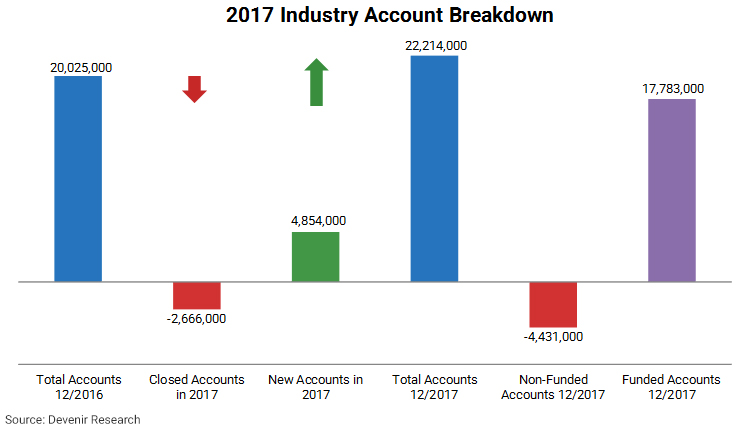

It’s a question we’ve been receiving a lot since we released our report in February and we wanted to help provide some clarity. We released results from our 2017 Year-End Devenir HSA Research Report in which we announced that at the end of 2017, HSA assets had grown to $45.2 billion (up 22% year-over-year) amongst 22.2 million accounts (up 11% year-over-year). Of the two figures, it was the account growth that caught many industry observer’s eyes.

While HSA account growth rates have been declining gradually over the last few years, the sharp drop from 20% growth in 2016 to 11% growth in 2017 caught many off guard, ourselves included. Once we dove into the results further, we saw that a significant portion of this large drop could be attributed to an uptick in the closure of accounts in 2017. Multiple HSA providers mentioned to us in their survey responses that they were making a bigger push to clean up dormant accounts throughout the year, which in turn also helped bring down the percentage of unfunded accounts from last year.

After accounting for the above cleaning up of dormant accounts, we believe the 2017 adjusted growth was closer to 15-16%. While this is still slower growth than we anticipated, it is a less drastic departure from the norm of the last several years.