MINNEAPOLIS (September 25, 2024) – Devenir, a national leader in providing investment solutions for Health Savings Accounts (HSAs), released today the results of its 28th semi-annual Health Savings Account survey and resulting research report. Devenir found that there was about $137 billion saved in almost 38 million HSAs at the midyear point of 2024.

The survey data was collected during the summer for the period ending on June 30th, 2024.

“Our latest survey highlights the unique versatility of HSAs in Americans’ financial strategies. We’re seeing increased recognition of HSAs’ long-term potential, as account holders with a portion of their HSA dollars invested hold an average balance of $20,677. Yet, their true strength lies in flexibility – enabling users to cover current health costs while offering a tax efficient savings vehicle for future expenses. This adaptability makes HSAs a crucial tool for managing healthcare finances across all life stages,” said Jon Robb, SVP of Research and Technology at Devenir.

Key findings from the Devenir 2024 Midyear HSA Survey and resulting research report:

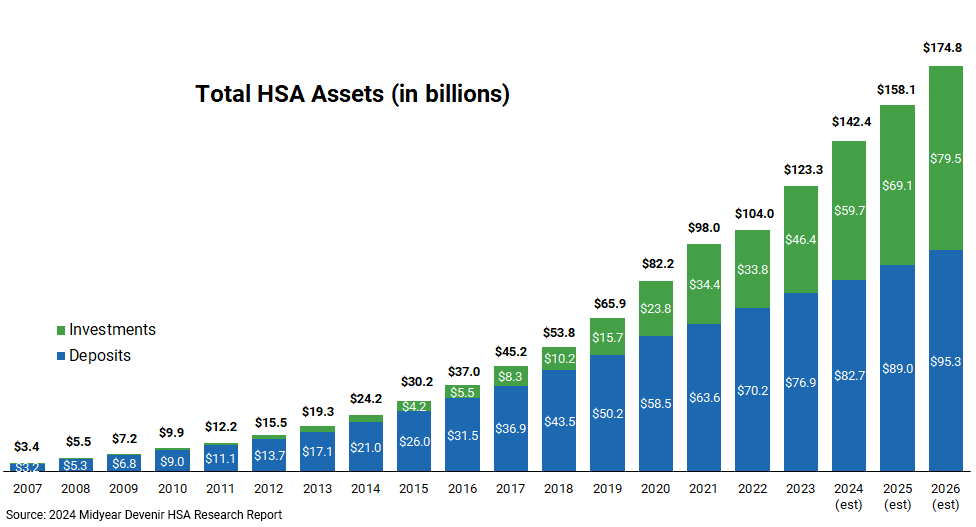

- Strong Asset Growth. Supported by stock market tailwinds, HSA assets saw continued strong growth during the first half of 2024. Growth in the number of HSAs continued. At the midyear point of 2024, there were $137 billion in HSA assets held in almost 38 million accounts, a year-over-year increase of 18% for assets and 5% for accounts.

- Rapid Growth in HSA Investment Assets. HSA investment assets saw continued rapid growth, driven by significant market returns during the first half of the year and increased recognition of HSAs’ long-term potential. During the first half of 2024, HSA investment assets grew 21%, totaling $56 billion at the midyear point.

- Increase in HSA Accounts Investing. The number of HSAs investing continued to grow. About 3.2 million HSAs, representing almost 9% of all accounts, had at least a portion of their HSA dollars invested.

- Slowing Withdrawal Activity. Account holders contributed $31 billion to their accounts in the first half of 2024 (up 6% from the year prior) and withdrew $20 billion from their accounts during the same period (down 2% from the year prior).

Devenir currently projects that the HSA market will exceed 43 million accounts by the end of 2026, holding nearly $175 billion in assets.

Click here to view the Executive Summary

Forward-looking statements are based on current expectations and assumptions derived from the 2024 Midyear Devenir HSA survey and other sources. They are subject to risks and uncertainties that could cause actual results to differ materially from those projected.

Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third-party administrators, health plans and technology providers. Learn more at devenir.com.

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]