MINNEAPOLIS — Devenir, a national leader in providing investment solutions for health savings accounts (HSAs), released today the results of its 18th semi-annual health savings account survey and resulting research report. Devenir found that the number of HSAs has grown to now exceed 26 million, holding an estimated $61.7 billion in assets halfway through 2019.

The survey data was collected in July of 2019 and primarily consisted of top 100 HSA providers in the health savings account market, with all data being collected for the period ending on June 30th, 2019.

Key findings from the Devenir 2019 Midyear HSA Survey and resulting research report:

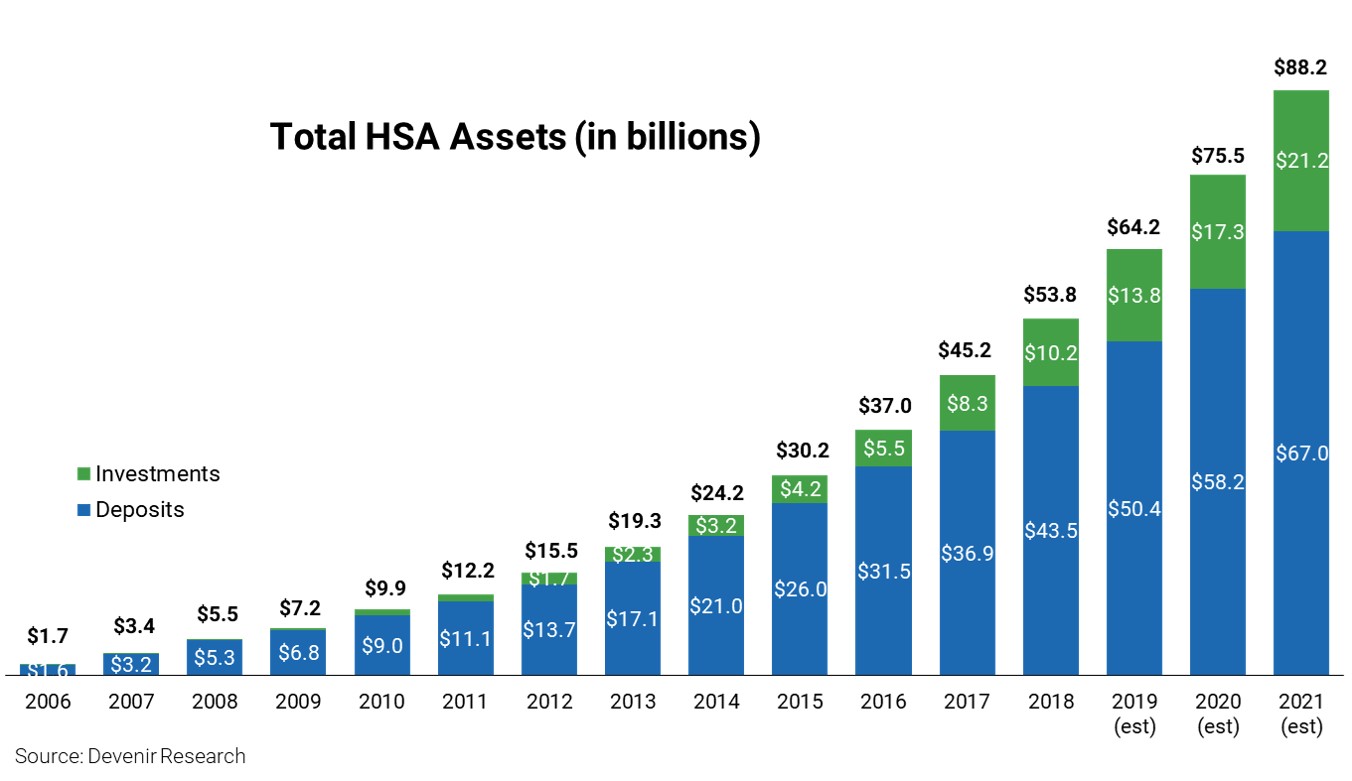

- HSA assets surpass $60 billion. There are now over 26 million health savings accounts, holding $61.7 billion in assets, a year-over-year increase of 12% for accounts and 20% for HSA assets for the period ending June 30th, 2019.

- HSA investment asset growth rebounds. Strong market tailwinds propelled HSA investment assets to an estimated $13.3 billion at the end of June, up 35% year-over-year. On average, investment account holders hold a $15,982 total balance (deposit and investment account).

- Over one million HSAs investing. There are now over one million accounts that are investing a portion of their HSA dollars, representing a little over 4% of all accounts.

- HSA contributions continue to rise. Account holders contributed over $22 billion to their accounts in the first six months of 2019, up 12% from the year prior.

“Health savings account holders are increasingly aware of their healthcare costs in retirement. To help meet those future healthcare expenses, over one million accounts are now investing their HSA dollars,” said Jon Robb, SVP of research and technology at Devenir.

Devenir projects that, by the end of 2021, the HSA market will approach $88 billion in HSA assets held by over 30 million accounts.

Click here to view the Executive Summary

Projections derived from 2019 Midyear Devenir HSA survey, press releases, previous market research, and market growth rates. Projections are barring any regulatory or market environment changes.

Forward-looking statements are based on current expectations and assumptions based on historical growth, the economy, other future conditions and forecasts of future events, circumstances and results.

About Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third party administrators, health plans and technology providers. Learn more at devenir.com

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]