- Total HSA assets reached $92.9 billion, 26% increase year-over-year

- HSA dollars that are invested soared to $30.4 billion, up 73% year-over-year

- There are now over 31 million health savings accounts, a 6% increase year-over-year

- Almost $24 billion was contributed to health savings accounts in the first half of 2021

MINNEAPOLIS (September 16, 2021) – Devenir, a national leader in providing investment solutions for health savings accounts (HSAs), released today the results of its 22nd semi-annual health savings account survey and resulting research report. Devenir found that there is now almost $93 billion saved in over 31 million HSAs halfway through 2021.

The survey data was primarily collected in July of 2021 and largely consisted of top 100 HSA providers in the health savings account market, with all data being collected for the period ending on June 30th, 2021.

“An increasing awareness of the role HSAs can play in planning for retirement healthcare costs and a strong stock market led to HSA investment assets soaring higher, with over 2 million accounts holding over $30 billion in invested assets at the 2021 midyear point,” said Jon Robb, SVP of research and technology at Devenir.

Key findings from the Devenir 2021 Midyear HSA Survey and resulting research report:

- Strong HSA asset growth. Led by strong investment growth, health savings accounts grew to $92.9 billion in assets held in over 31 million accounts, a year-over-year increase of 26% for assets and 6% for health savings accounts for the period ended June 30th, 2021.

- HSA investment asset growth doesn’t slow down. Fueled by continued strong market gains, HSA investment assets soared to an estimated $30.4 billion at the end of June, up 73% year-over-year. On average, investment account holders hold a $17,954 total balance (deposits and investments combined).

- Interest in HSA investing continues to grow. There are now almost 2 million accounts that are investing a portion of their HSA dollars, representing over 6% of all accounts.

- HSA contribution and withdrawal growth flat. Account holders contributed almost $24 billion to their accounts in the first half of 2021 (up 1% from the year prior) and withdrew over $16 billion from their accounts in the first half of 2021 (down 1% from year prior).

Click here to view the Executive Summary

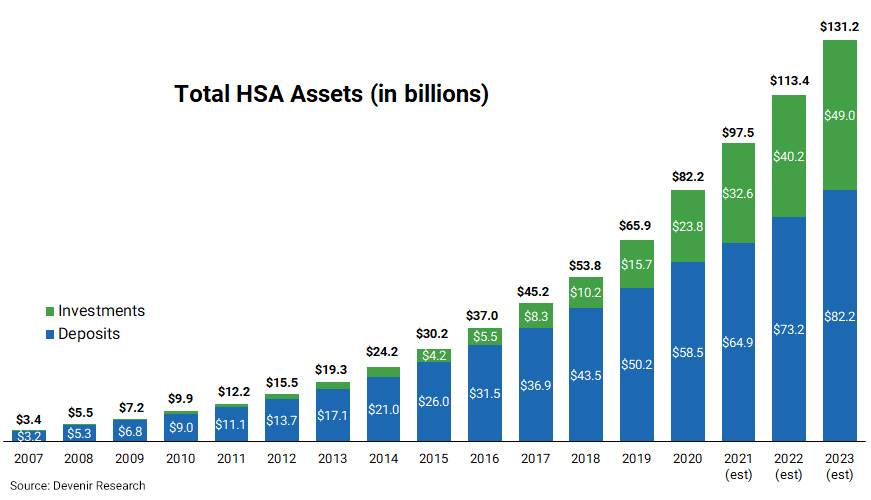

Devenir currently projects that the HSA market will exceed 36 million accounts by the end of 2023, holding over $131 billion in assets.

Projections derived from 2021 Midyear Devenir HSA survey, press releases, previous market research, and market growth rates. Projections are barring any regulatory or market environment changes.

Forward-looking statements are based on current expectations and assumptions based on historical growth, the economy, other future conditions and forecasts of future events, circumstances, and results.

About Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third party administrators, health plans and technology providers. Learn more at devenir.com.

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]