The majority of this report was derived from the 2018 Year-End Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in January, 2019 and primarily consisted of top 100 HSA providers in the health savings account market. All data was requested for the period ending on December 31st, 2018.

Key Findings

- HSA accounts exceed 25 million. The total number of HSAs grew to 25 million at the end of 2018, up 13% from a year ago.

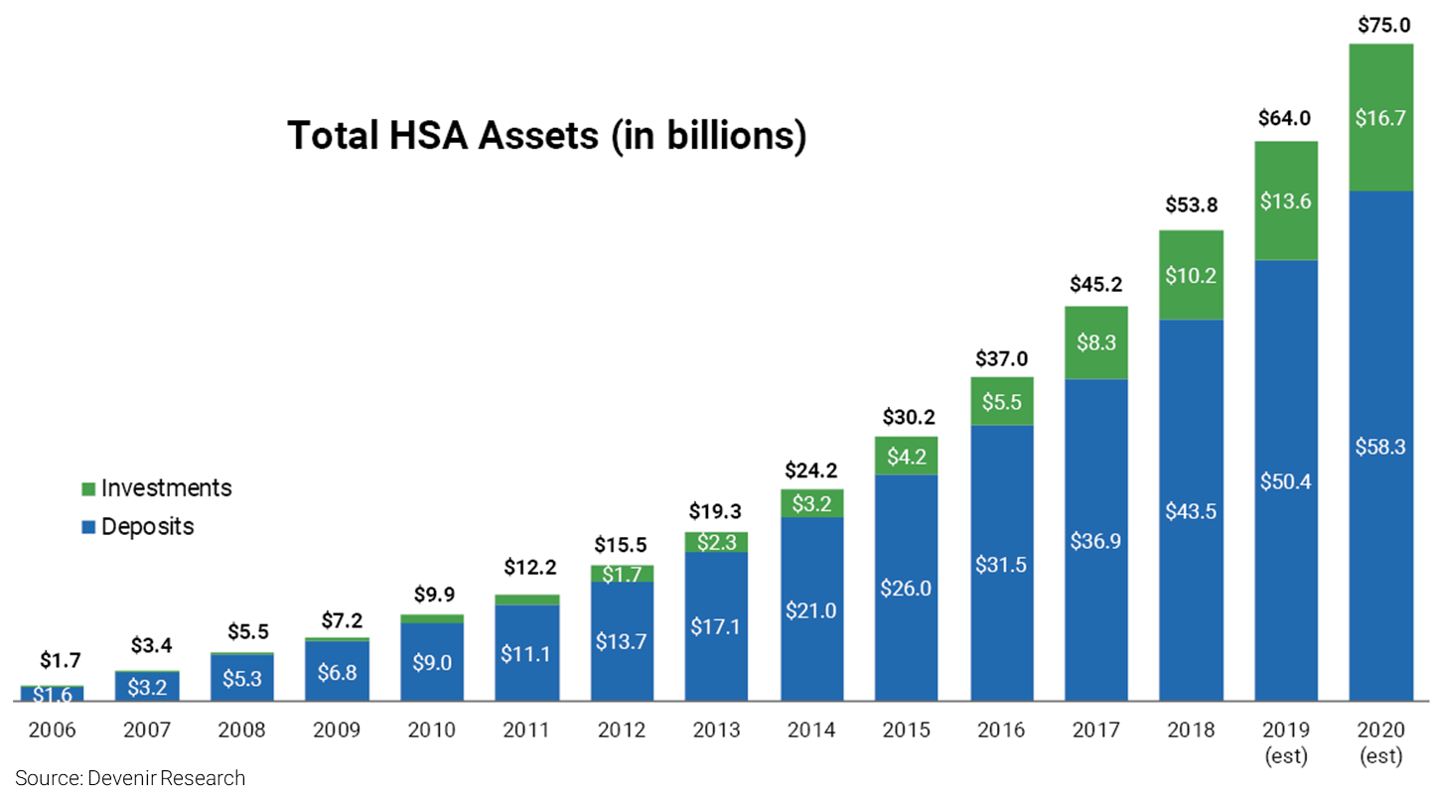

- Stable asset growth. HSA consumers had accumulated $53.8 billion in their HSAs at the end of 2018, a year over year increase of 19%. Devenir expects this number to grow to $75 billion by the end of 2020.

- HSA investment assets surpass $10 billion mark. Despite strong market headwinds, HSA investment assets reached an estimated $10.2 billion at the end of December, up 23% year-over-year. On average, investment account holders hold a $14,617 total balance (deposit and investment account).

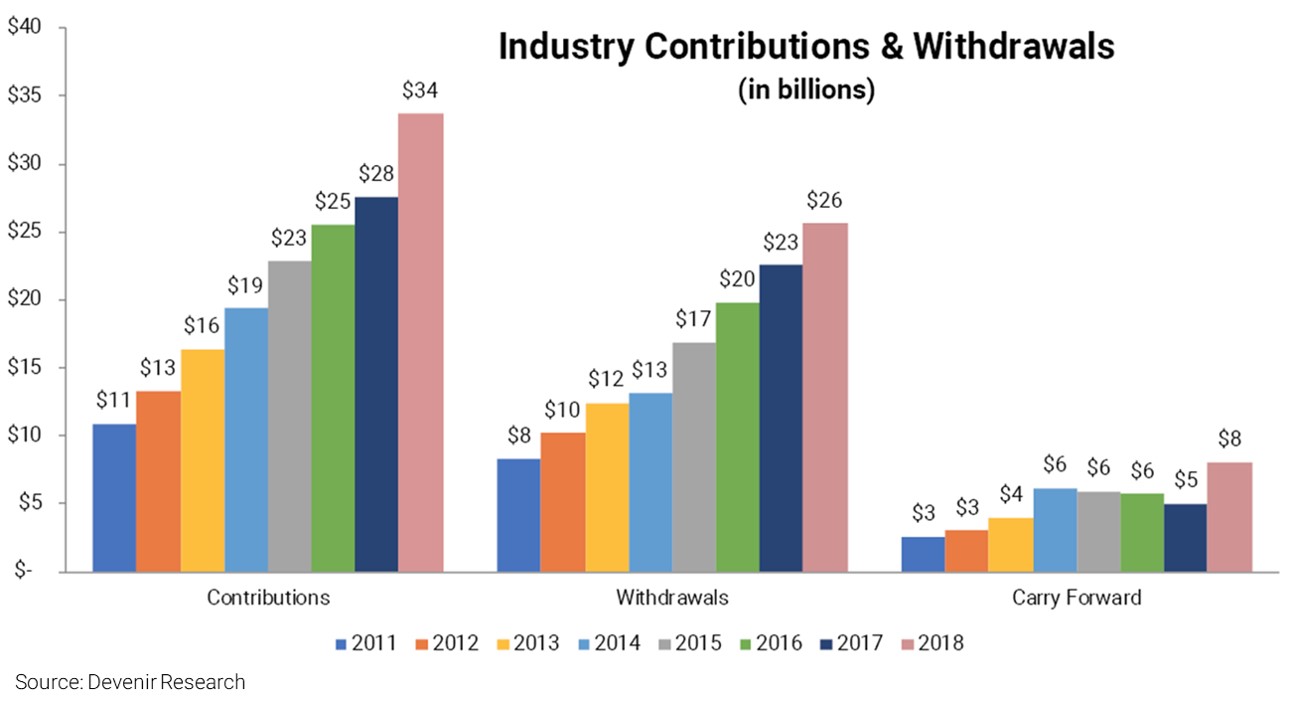

- HSA contributions jump. HSA account holders contributed almost $33.7 billion to their accounts in 2018, up 22% from the year before.

- Increase in employer contributions. For accounts receiving an employer contribution in 2018, the average contribution amount rose to $839 (up from $604 in 2017).

Devenir projects that, by the end of 2020, the HSA market will approach $75 billion in HSA assets covering roughly 30 million accounts.