The majority of this report was derived from the 2021 Midyear Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in July 2021, and primarily consisted of top 100 providers in the health savings account market. All data was requested for the period ending on June 30th, 2021.

Key Findings

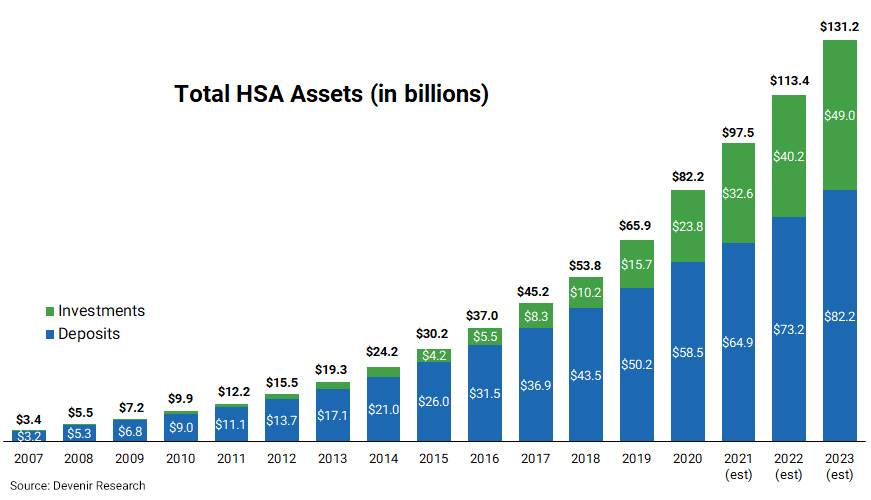

- Strong HSA asset growth. Led by strong investment growth, health savings accounts grew to $92.9 billion in assets held in over 31 million accounts, a year-over-year increase of 26% for assets and 6% for health savings accounts for the period ended June 30th, 2021.

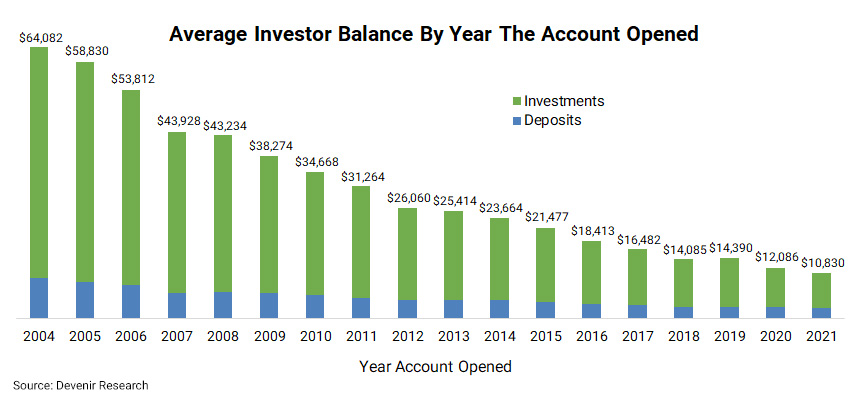

- HSA investment asset growth doesn’t slow down. Fueled by continued strong market gains, HSA investment assets soared to an estimated $30.4 billion at the end of June, up 73% year-over-year. On average, investment account holders hold a $17,954 total balance (deposits and investments combined).

- Interest in HSA investing continues to grow. There are now almost 2 million accounts that are investing a portion of their HSA dollars, representing over 6% of all accounts.

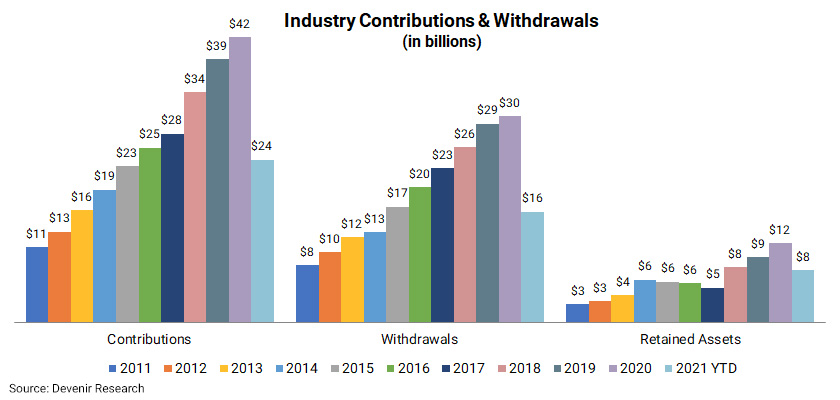

- HSA contribution and withdrawal growth flat. Account holders contributed almost $24 billion to their accounts in the first half of 2021 (up 1% from the year prior) and withdrew $16 billion from their accounts in the first half of 2021 (down 1% from year prior).

Devenir currently projects that the HSA market will exceed 36 million accounts by the end of 2023, holding over $131 billion in assets.