The majority of this report was derived from the 2021 Year-End Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in January 2022, with data requested for the period ending on December 31st, 2021.

Key Findings

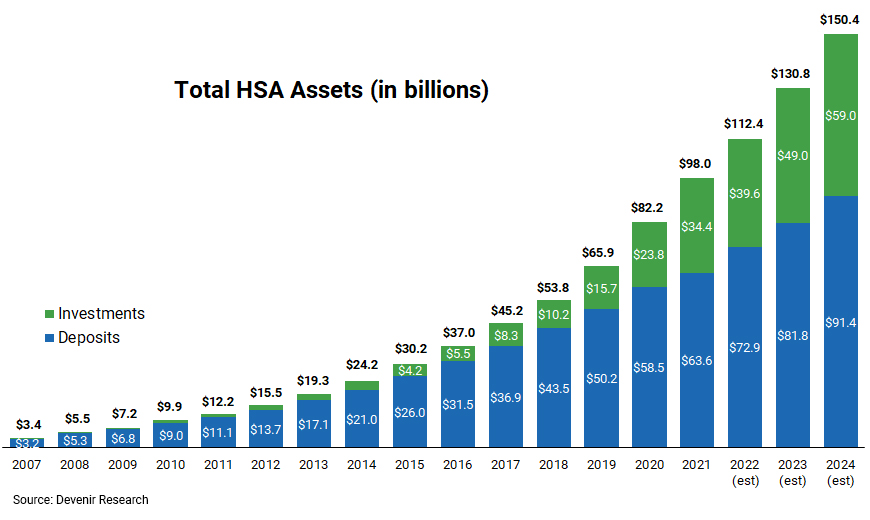

- Healthy growth in HSA assets. Driven by robust investment growth, health savings accounts grew to $98.0 billion in assets held in over 32 million accounts, a year-over-year increase of 19% for assets and 8% for health savings accounts for the period ending December 31st, 2021.

- Strong HSA investment asset growth. With a growing base of investors and continued strong market gains, HSA investment assets rose to an estimated $34.4 billion at the end of the year, up 45% year-over-year. On average, investment account holders have a $19,224 total balance (deposits and investments combined).

- Participation in HSA investing increases. Over 2 million health savings accounts have at least a portion of their HSA dollars invested, representing over 7% of all accounts.

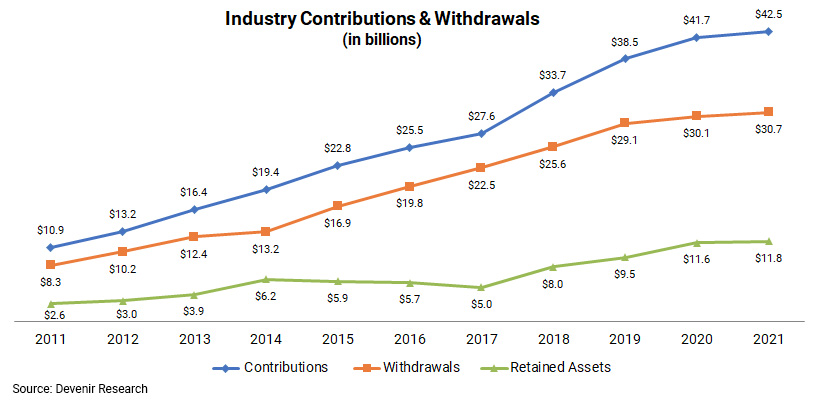

- HSA contribution and withdrawal growth remains muted. Account holders contributed over $42 billion to their accounts in 2021 (up 2% from the year prior) and withdrew almost $31 billion from their accounts in 2021 (up 2% from year prior).

Devenir currently projects that the HSA market will reach 38 million accounts by the end of 2024, holding $150 billion in assets.