The majority of this report was derived from the 2023 Midyear Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in the summer of 2023, with data requested for the period ending on June 30th, 2023.

Key Findings

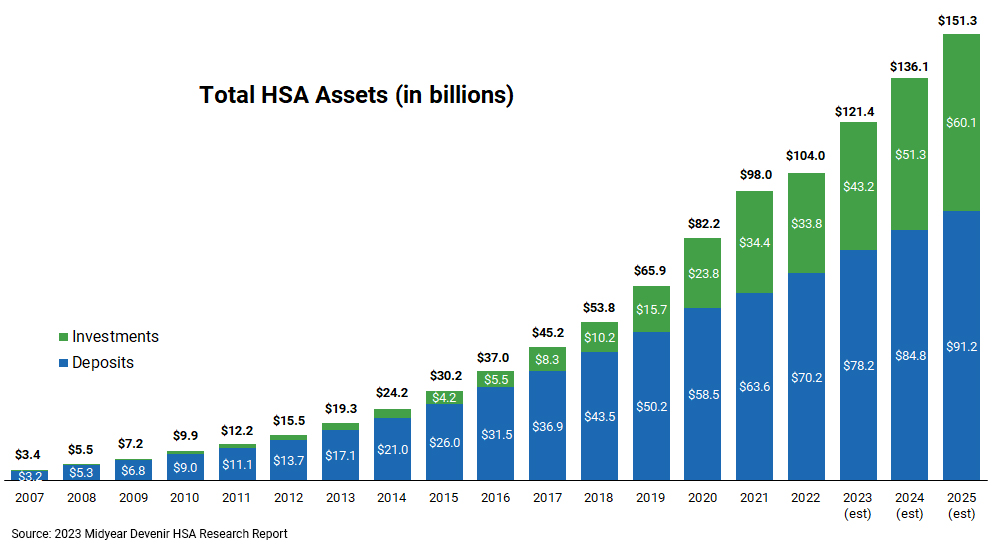

- Robust asset growth. Aided by stock market tailwinds, HSA assets saw strong growth during the first half of 2023. Growth in the number of HSAs slowed. At the midyear point of 2023, there were $116 billion in HSA assets held in almost 36 million accounts, a year-over-year increase of 17% for assets and 6% for accounts.

- HSA investment assets soar. After enduring one of the worst stock markets in decades during the first half of 2022, HSA investment assets have seen rapid growth. During the first half of 2023, HSA investment assets grew 20%, totaling $40 billion at the end of June (up 30% from the year prior).

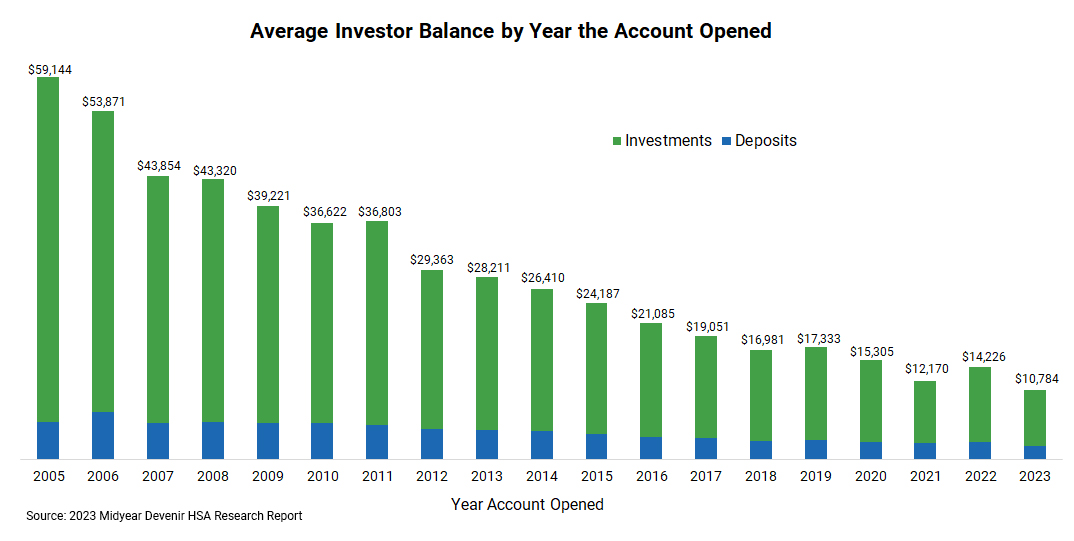

- Growth of HSA accounts investing slows. The number of HSAs investing continues to grow but the rapid growth seen over the last few years has slowed. Almost 2.7 million HSAs, representing over 7% of all accounts, have at least a portion of their HSA dollars invested.

- Strong contribution and withdrawal activity. Account holders contributed $29 billion to their accounts in the first half of 2023 (up 11% from the year prior) and withdrew $21 billion from their accounts during the first half of 2023 (up 16% from year prior).

Devenir currently projects that the HSA market will exceed 40 million accounts by the end of 2025, holding over $150 billion in assets.