The majority of this report was derived from the 2024 Midyear Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in the summer of 2024, with data requested for the period ending on June 30th, 2024.

Key Findings

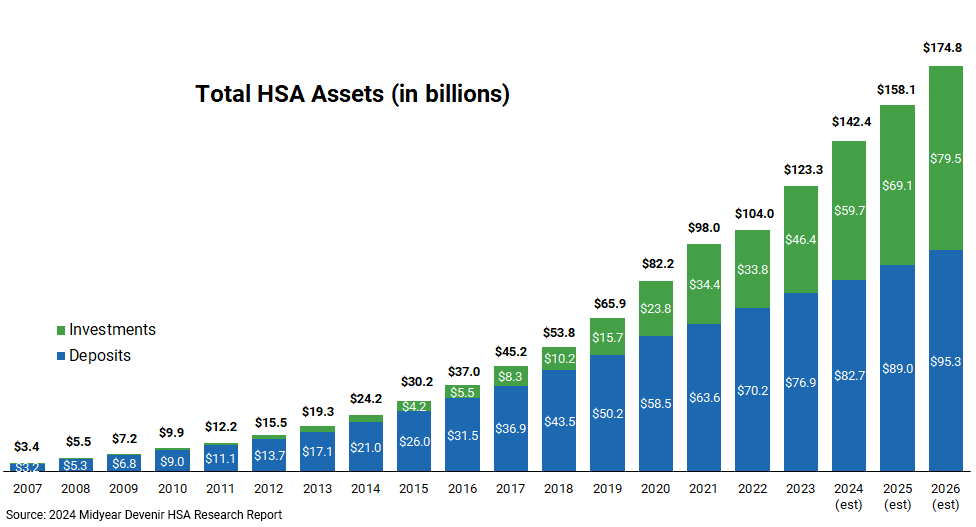

- Strong asset growth. Supported by stock market tailwinds, HSA assets saw continued strong growth during the first half of 2024. Growth in the number of HSAs continued. At the midyear point of 2024, there were $137 billion in HSA assets held in almost 38 million accounts, a year-over-year increase of 18% for assets and 5% for accounts.

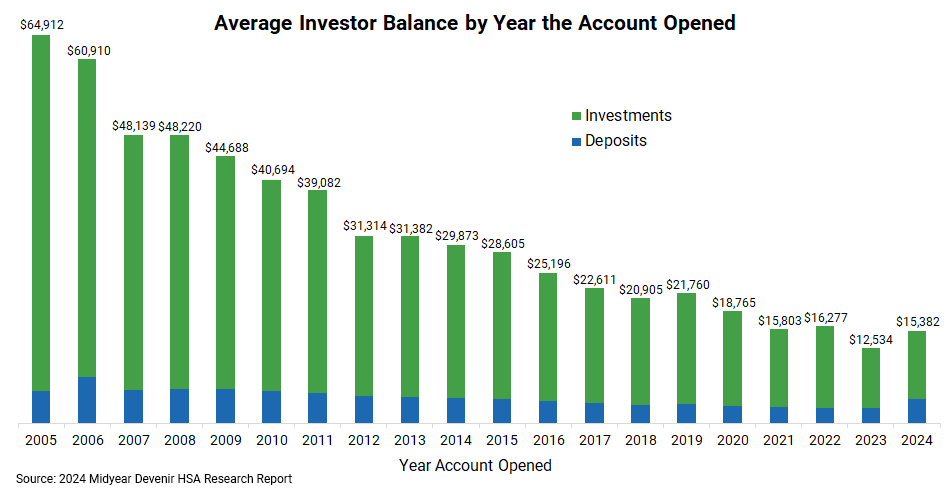

- Rapid growth in HSA investment assets. HSA investment assets saw continued rapid growth, driven by significant market returns during the first half of the year and increased recognition of HSAs’ long-term potential. During the first half of 2024, HSA investment assets grew 21%, totaling $56 billion at the midyear point.

- Increase in HSA accounts investing. The number of HSAs investing continued to grow. About 3.2 million HSAs, representing almost 9% of all accounts, had at least a portion of their HSA dollars invested.

- Slowing withdrawal activity. Account holders contributed $31 billion to their accounts in the first half of 2024 (up 6% from the year prior) and withdrew $20 billion from their accounts during the same period (down 2% from the year prior).

Devenir currently projects that the HSA market will grow to exceed 43 million accounts by the end of 2026, holding nearly $175 billion in assets.